VAT vs the fuel levy trade-off

VAT vs the fuel levy trade-off

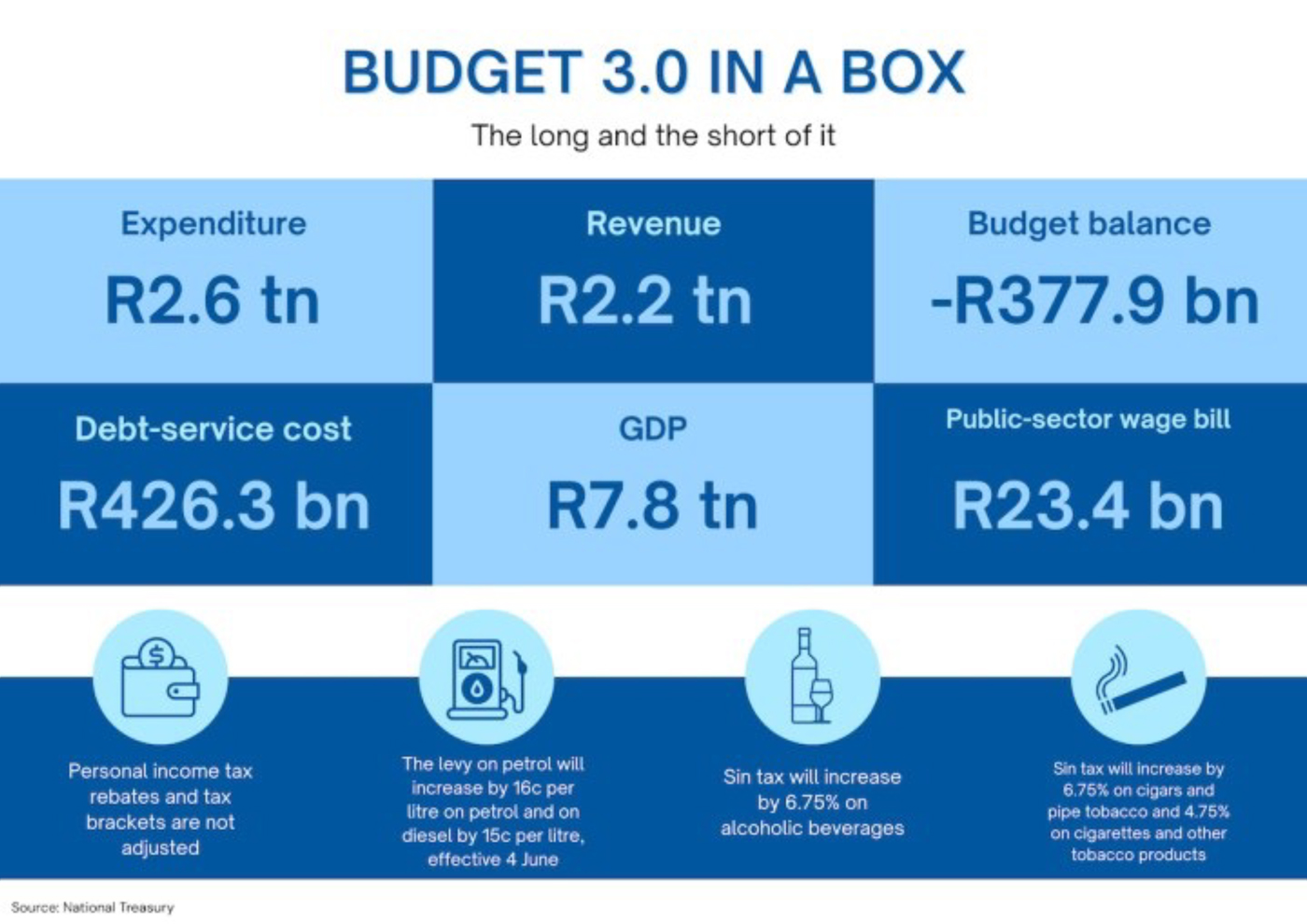

On 21 May, Finance Minister Enoch Godongwana presented his SA Budget “version 3.0” in parliament. SHARMINI NAIDOO reports that, with the VAT increase off the table, the minister needed to find another way to plug the gaping hole.

Godongwana made it very clear that this was not an austerity budget, but a redistributive one. He indicated that the budget was a reflection of the difficult trade-offs needed to balance fiscal sustainability while addressing developmental goals.

Here are the highlights:

- Growth projections for the economy this year have been revised from March’s 1.8% to just 1.4%.

- The expansion of the zero-rated basket – included to cushion poorer households from the proposed VAT rate increase – falls away due to the VAT increase reversal.

- Tax revenue projections have been revised downward by R61.9 billion over the three years, as a result of the VAT increase reversal and the lower economic outlook.

- Additional spending over the medium term has been reduced by R68 billion.

- Government debt as a percentage of GDP is expected to increase to 77.4% in 2025/2026.

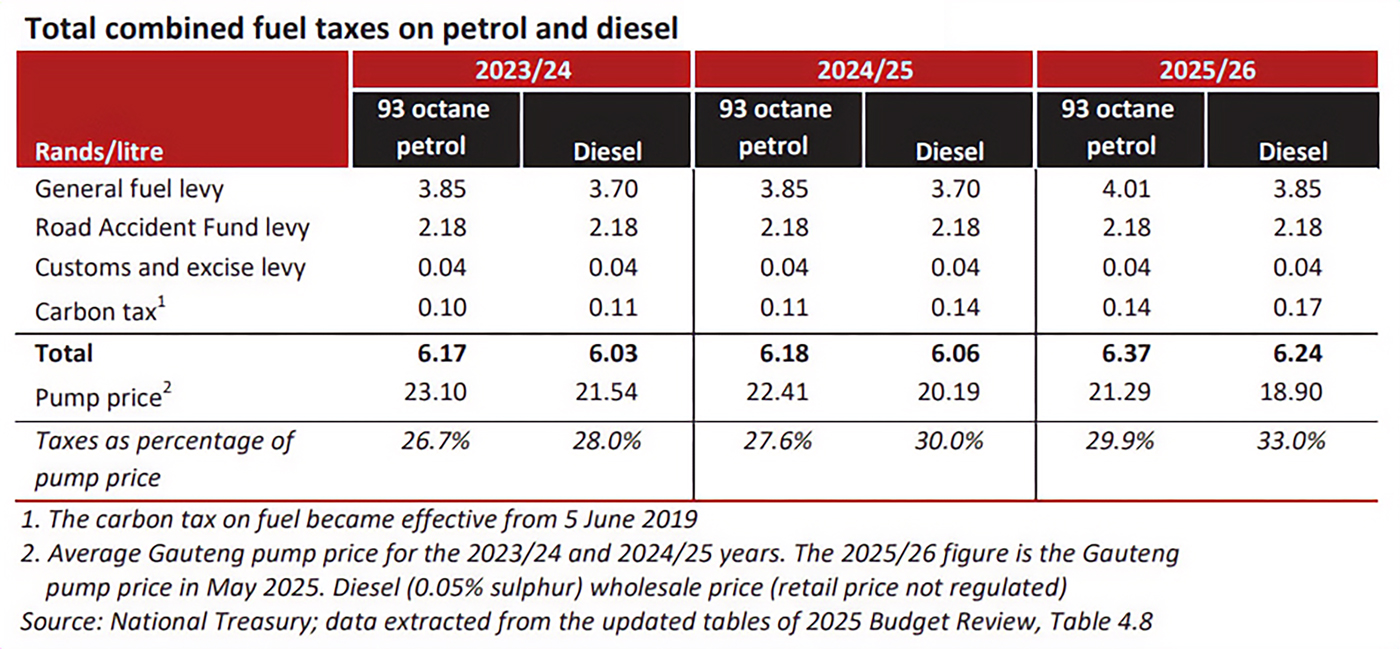

- On 4 June, the general fuel levy increased by 16c to R4.01/litre for petrol and by 15c to R3.85/litre for diesel.

- No changes have been made to adjustments in income tax brackets or medical aid credits.

- Pension and other social grant increases in the March budgethave been retained.

- Above-inflation increases in the sin tax hikes announced in the March budget have been retained.

- The 3c/litre hike in the carbon fuel tax increase that was applied in April was also retained.

The announcement of the increase of the fuel levy to raise additional revenue will cost the transport industry dearly – not to mention motorists, commuters, and the geberal public, who are already under tremendous pressure to make ends meet.

This trade-off was perceived as the lesser of the two evils and the only other avenue at the Minister’s disposal. National Treasury has, however, indicated that the increase was due to inflationary pressure and has not been implemented as a revenue-generating tool.

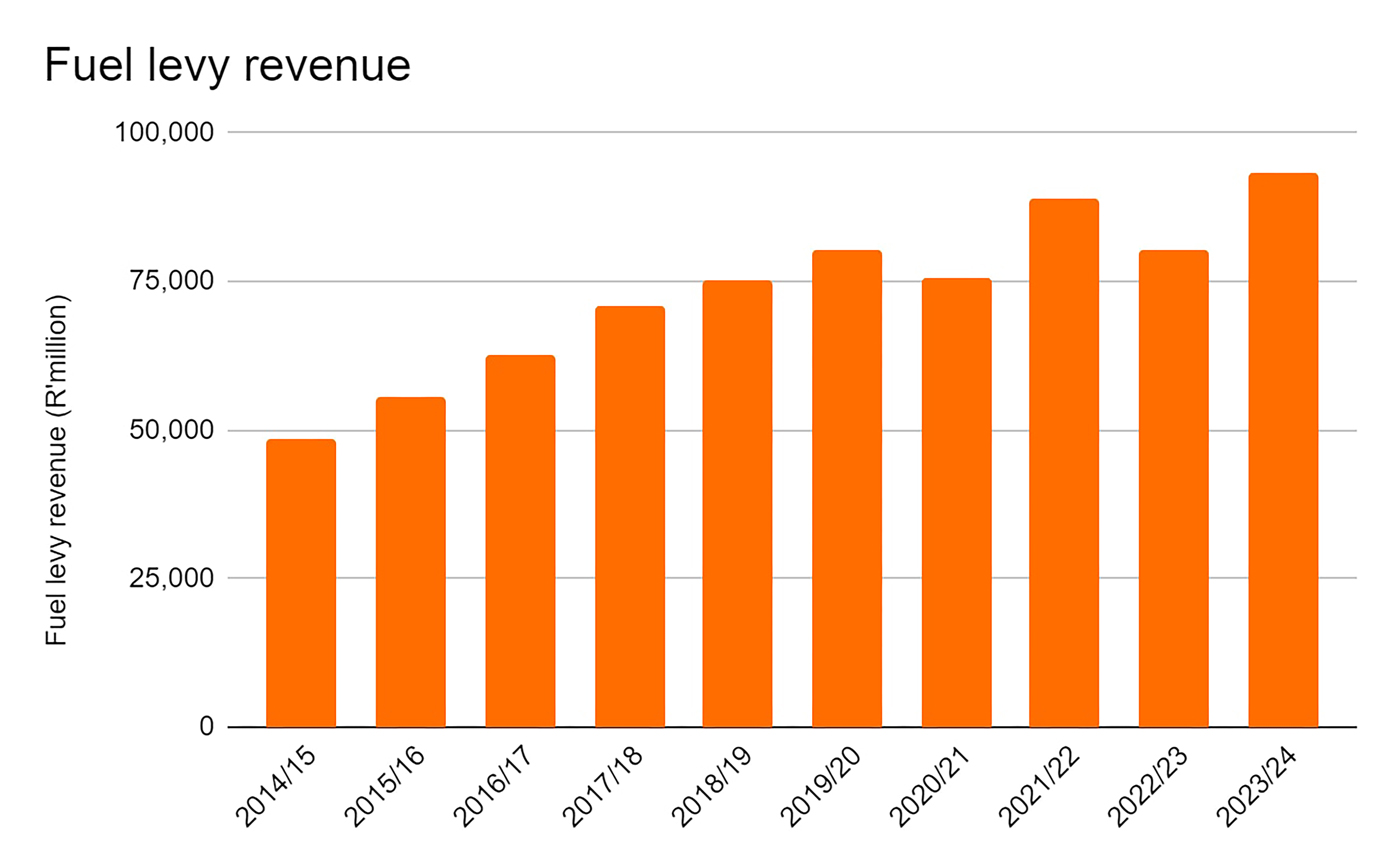

The increase in the fuel levy is expected to raise up to R4 billion in the 2025 financial year, while further increases in the general fuel levy are expected in the next two years. In recent years, the fuel levy has served to fill in the tax gap, and it has not been used as it was intended when it was first introduced.

Unpacking the fuel levy

Here’s a look at how the fuel levy was initiated and how its utilisation evolved.

Between 1925 and 1935, government decided that the funding of national roads would no longer be subsidised by provincial and local authorities. Hence, it was decided that public road users would be taxed. This resulted in the establishment of a National Road Fund in 1935 to fund mainly national roads for national development and unity. At the time, a percentage of the import tax from every litre of fuel imported (three pennies per gallon) went to the fund.

Even after subsequent increases in the levies, it became apparent that the National Road Fund needed more revenue to be able to repay National Treasury bonds. It also needed money for the construction of urban highways (in Johannesburg, Cape Town, Durban, and Port Elizabeth).

In 1961, it was decided that the fund would acquire income from a tax on all imported and locally-produced petrol, diesel, oil, and paraffin. Over the next 12 years, it was planned that the fund would distribute 60% of the income for construction or reconstruction of national roads and bridges. A further 12% would be spent building new urban freeways in metropolitan areas, while 11.5% was reserved for assisting on special roads and 8% for maintenance.

However, with the decrease in fuel consumption resulting from savings regulations due to international sanctions, the fund experienced dwindling revenues. Hence, by the 1980s, tolls were introduced to fund new roads or road improvements on stretches where an alternative route existed. The introduction of tolls would come as an additional cost to road users but was “sold” to transport operators (to soften the blow) as a means to have dedicated funds for roads and infrastructure (amongst other competing state expenditure).

During the period 1983 to 1988, as promised, we were fortunate enough to see a dedicated, ring-fenced fuel levy, in addition to tolls. In 1988 however, then-Minister of Finance Barend du Plessis amended the legislation, changing the ring-fenced fuel levy to a general levy, where the income could be used for other government expenditure programmes.

With a growing number of vehicles on the road, more available public transport, increasing road freight, and escalations in the fuel levy, this has brought in a tidy sum of money to the fiscus over the years, with very little finding its way into the roads.

Ironically, at the time of consultations over the Gauteng Freeway Improvement Project (e-toll), which has now been scrapped, the transport industry was told that – due to the buoyancy of the fuel levy – it could not be utilised to pay for the e-tolls and required a user-pay approach. Years later, however, it is now a stable enough mechanism to fill the state’s coffers (or is this perhaps an act of desperation?).

Godongwana also announced that the 2026 Budget would propose tax measures to raise an additional R20 billion in revenue. He did not provide any indication as to where this will originate from, so we will have to brace ourselves for more shock announcements in the coming months.

Draft Transformation Fund tabled

In the meantime, the Department of Trade, Industry and Competition (DTIC) has published the draft Transformation Fund Concept for comment. Government, in partnership with the private sector, is seeking to establish a R100-billion aggregated fund to support the “ever-growing requirements for businesses owned and managed by black entrepreneurs to propel inclusive growth across various sectors of South Africa’s economy”. The fund is expected to be capitalised at R20 billion per annum over a five-year period. It will be administered through a Special Purpose Vehicle (SPV) with a board of directors constituted by government and the private sector, which will oversee the implementation thereof.

Funds are expected to be sourced from government contributions, equity equivalent investment programmes (EEIP), and enterprise and supplier development (ESD) funds. Funding mechanisms for measured entities (as per the B-BBEE Act) will be restricted to grants. Loan payment guarantees will not be allowed.

Two percent of net profit after tax (NPAT) for Supplier Development and 1% of NPAT for Enterprise Development is intended to be contributed to the fund. Measured entities will have no influence on the sectoral allocation of the Fund. In other words, contributions received from a particular sector, such as the transport sector, could go to other sectors and not be utilised for the sector itself. In fact, the fund mentions a focus on productive sectors and services, and the transport industry is not specifically identified as one of these. Based on the ESD contributions made and contributions through the EEIP, the private sector will be contributing to about 75% of the fund.

In an address on 16 May regarding the Department of Transport’s role in the transformation of the sector and support for the Integrated Transport Sector Charter Council, the Minister of Transport indicated that a comprehensive Draft Charter will soon be gazetted for 60 days of public comment. This will close the “long chapter of uncertainty” and directly contribute to the development of the Transformation Fund. The revised Transport Sector Codes will “introduce the formation of a sector-specific ESD Fund, mandating that a significant portion of enterprise and supplier development spend be directed toward this mechanism. In alignment with national imperatives, the Transport ESD Fund formally pledges its support – and financial contribution – to the broader Transformation Fund, anchoring the sector’s commitment to inclusive growth and meaningful economic participation…”

The transport industry must now wait to learn more about this development in the upcoming months. Whether transport operators’ comments will really be taken into account in the public commentary process remains to be seen!

Published by

Sharmini Naidoo

focusmagsa