Terrifying fuel prices: Who is to blame?

Terrifying fuel prices: Who is to blame?

This year just hasn’t been fun. Quite frankly, we’ve just had too much with which to contend. I am, of course, referring to the pandemic, the riots and violence, the shortage of semiconductors, the chaos at our border posts … and more. As if that wasn’t enough, we’re also now dealing with scary fuel prices. Who is to blame?

One of the reasons for our sky-high fuel cost is the hike in the price of Brent crude. Last month, oil prices jumped to a three-year high – clocking in at above $85 a barrel. Economists are blaming anything and everything from supply shortages to an easing of coronavirus-related travel restrictions – which has meant that there is more demand for oil.

The bad news is that, if the Bank of America is to be believed, this is only the tip of the oil price iceberg. A CNN Business article reveals that the bank is expecting Brent crude oil prices to rise to $120 a barrel by June 2022 (45% higher than current levels).

There’s not much that anyone can do about that. But, while it acknowledges that the price of Brent crude does play an important role, the Organisation Undoing Tax Abuse (OUTA) says that other factors come into play too. “Two local factors that contribute to our current high fuel prices are the weak value of the rand – which we put down largely to poor government economic policy and mismanagement of our fiscal affairs – and our government’s incessant desire to increase taxes on motorists through fuel-related levies over the years,” asserts Wayne Duvenage, its CEO.

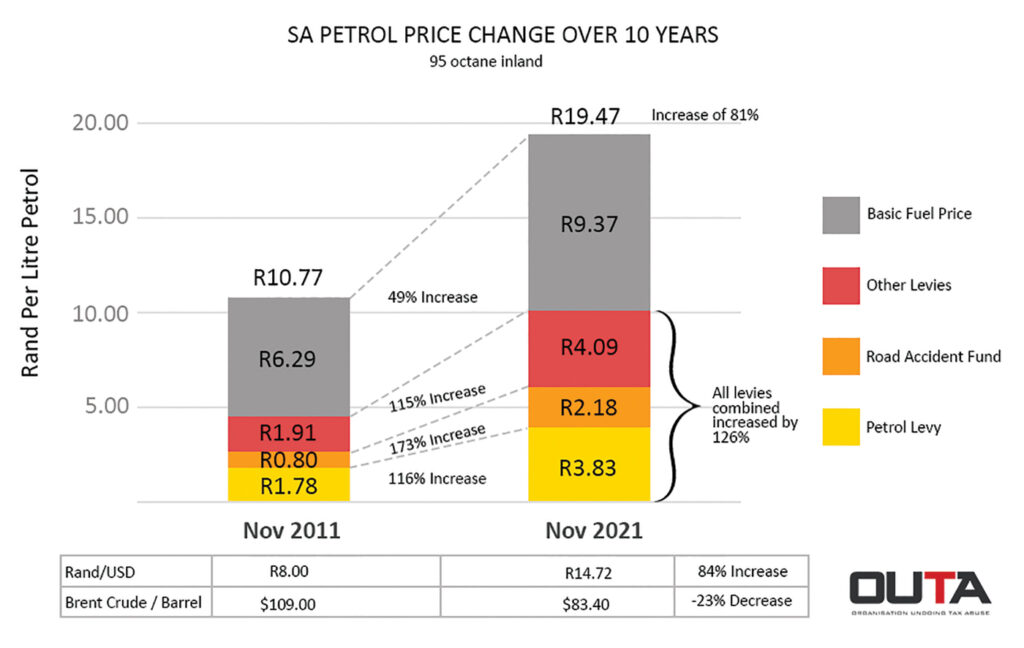

He notes that this is not the first time that we’re seeing an increase in the price of Brent crude. “A decade ago, the international price of oil was significantly higher than it is now. Back in November 2011, Brent crude was $109 per barrel, some 31% higher than it is today. Fortunately for us at the time, the rand was a lot better off at R8 to the US dollar, compared to today’s exchange rate of R14,72 (some 84% higher). If we had the same rand/dollar exchange rate today, the current petrol price would be around R16,00 per litre of 95 octane petrol (inland price). That’s roughly R3,50 lower. This is the price of a weaker currency,” Duvenage contends.

These two factors (a weaker rand and higher cost of oil) have seen the basic fuel price (BFP) component of our petrol price move from R6,29 per litre for 95 octane petrol (inland) up to R9,37 per litre. However, despite the higher BFP component, Duvenage maintains that our concern should be focused on the 126% increase in the various levies and taxes applied over the past decade.

“In November 2011, the combined cost of the General Fuel Levy, the Road Accident Fund (RAF) levy and other levies amounted to R4,48 of each litre of 95 octane petrol. That amount today is R10,10, some 126% higher than a decade ago,” he points out.

OUTA maintains again, as it has on numerous occasions, that the state has pushed the envelope on fuel levy increases too far and should seriously consider pulling back on seeking additional tax revenue.

“Furthermore, the current fuel tax revenues the state relies on – in particular the General Fuel Levy (around R88bn per annum) and the RAF levy (around R45bn) – will come under significant pressure over the coming decade, as the transition to electric vehicles becomes a reality. The state will be hard pressed to replace these revenue streams though other mechanisms and should seriously consider zero increases to fuel levies going forward,” says Duvenage.

If this doesn’t happen, and levies and taxes keep increasing, who knows where the petrol and diesel price will end up. Double what they are now? So, roughly, R38 and R34/litre? Can you imagine the impact on our economy?

As Layton Beard, Automobile Association spokesman, points out: “The fuel price has a direct bearing on an already weak economy as it continues to drive up inflation on essential consumer goods and affects every South African.”

So, it won’t just be a case of the transport industry being brought to its knees. That sorry state of affairs will apply to each and every South African.

Published by

Charleen Clarke

focusmagsa