Transport and logistics under pressure

South African households are feeling the pressure of the weak economy and load shedding. With both consumer and business confidence negative in the fourth quarter of 2019, most freight transporters are feeling the effects in terms of tonnages and a decline in real income.

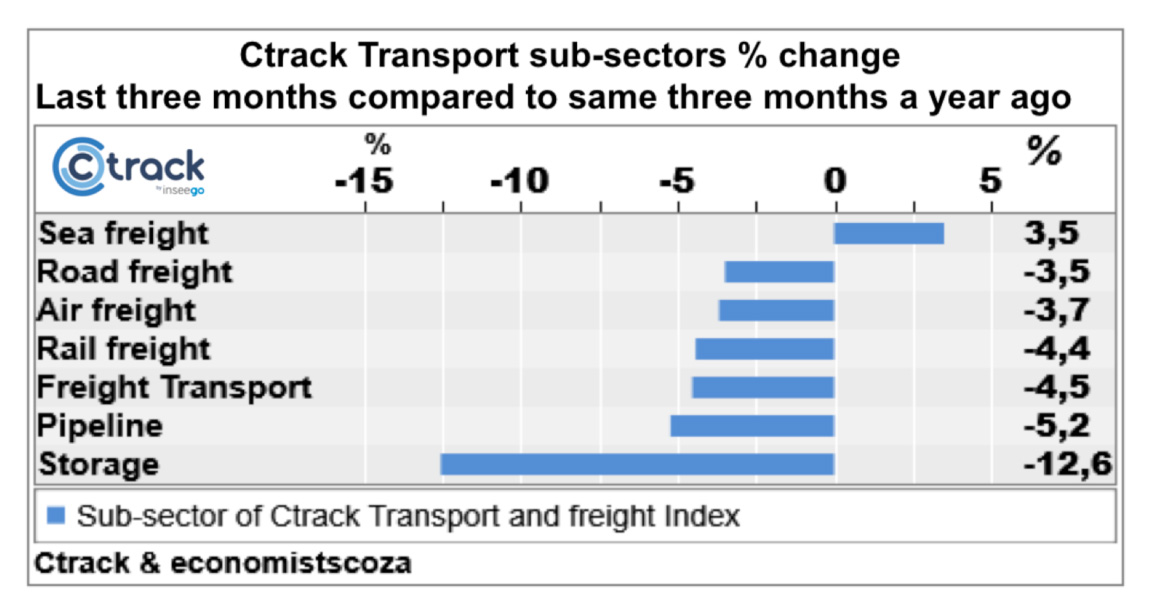

According to the latest Ctrack Freight & Transport Index, only sea freight volumes recorded positive growth during the quarter.

Land transport, which had maintained positive numbers until September for rail freight and October for road freight, has given way to year-on-year declines. In addition, pipeline volumes declined by 5,2 percent in 2019.

Chart 1: The Ctrack Freight & Transport Index subsectors

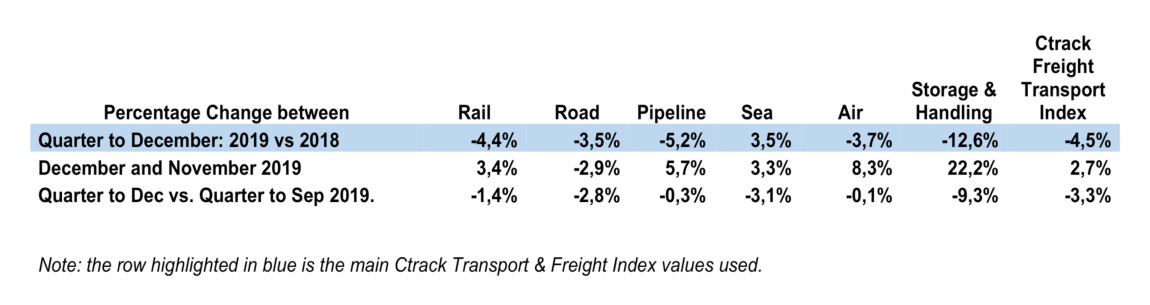

The good news is that December 2019 saw positive changes in five of the six sectors on a seasonally adjusted basis, despite load shedding, but can this be maintained?

The good news is that December 2019 saw positive changes in five of the six sectors on a seasonally adjusted basis, despite load shedding, but can this be maintained?

Lower outputs were possibly recorded in December 2019 from manufacturing and mining. Some retailers pointed to disappointing sales in December, and the rise in inventories is likely due to misjudged sales expectations.

In this weak climate, it is vital that companies control costs with better route planning, security and the rightsizing of equipment. More than ever, knowledge in the organisation will make a difference – from the drivers to supervisors and managers. Being informed is being prepared in this environment.

Chart 2: Ctrack Freight & Transport Index

At present, vehicle exports are growing, but the number of containers shipped is in decline. As containers are more likely to house higher-value goods, the reduction is at least partly due to a slowdown in the manufacturing of foods, clothes, higher-value steel products and the like.

At present, vehicle exports are growing, but the number of containers shipped is in decline. As containers are more likely to house higher-value goods, the reduction is at least partly due to a slowdown in the manufacturing of foods, clothes, higher-value steel products and the like.

Most containers landed contain consumer goods destined for retail shelves. However, consumers are increasingly buying bargains, as shown by strong Black Friday and Cyber Monday sales.

Bulk commodities increased by 10,4 percent, with coal and iron ore leading the way. The leading destination for South Africa’s Iron Ore is China, while India takes the lion’s share of the country’s coal.

With the Coronavirus outbreak impacting China, exported iron ore volumes may record a decline. The significant bulk imported into South Africa is oil, which had a minimal volume increase in the last few months.

Imports of breakbulk were up by 14 percent in the fourth quarter. Not all of this is necessarily good news, however, as these imports could be for drought-stricken parts of South Africa and its neighbours.

Broad data shows that some mining can produce more, or at least has stocks in reserves, to maintain export performance. Consumer imports are struggling, but vehicle exports continue to grow. Older data shows that vehicle import volumes are constrained.

Table of Freight & Transport volume changes:

Published by

Focus on Transport

focusmagsa