Stop talking, start walking

Stop talking, start walking

The non-profit anti-corruption advocacy company Organisation Undoing Tax Abuse (OUTA) says that the government should act more and speak less when it comes to fuel tax cuts.

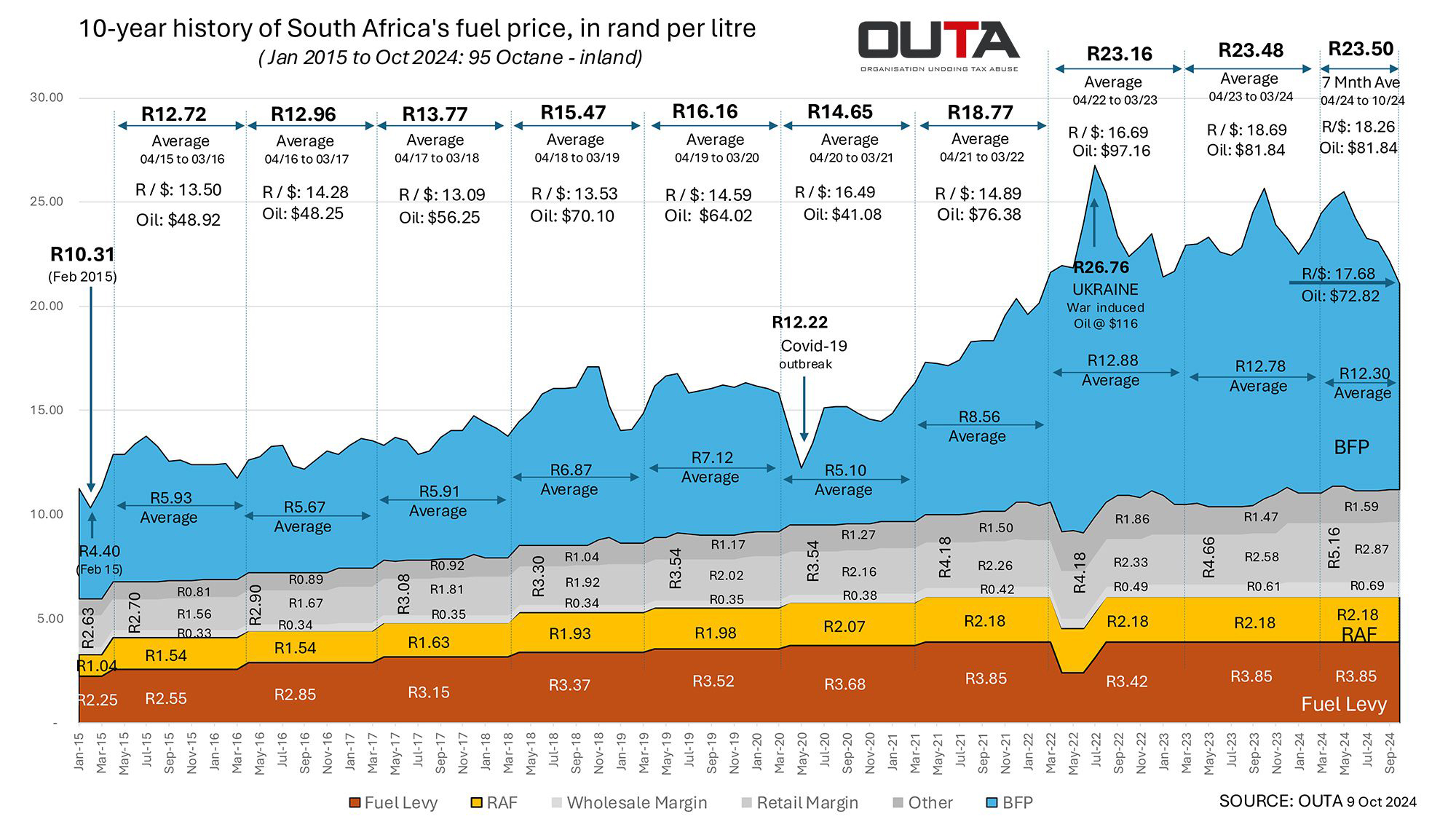

For many years now, South Africans have been listening to politicians talking about removing the tax components in order to lower the price of petrol, but nothing has really come from these not-so-bright suggestions. The only relief has been a brief reduction in the General Fuel Levy in 2022, when the Russian invasion of Ukraine pushed up the international oil price, sending the Basic Fuel Price (BFP) component of our petrol price soaring.

It’s all very well to speak of a petrol price of R14/litre, but that would require the Minister of Finance to remove the General Fuel Levy – currently at R3.85 – and the Road Accident Fund (RAF) Levy, which stands at R2.18/litre.

Our reality is that we have watched our petrol price fluctuate at the mercy of two main components: the international oil price – which is subjected to geopolitical forces – and the rand’s currency exchange rate, which is influenced by our own political conduct and economic conditions.

There is of course the issue of a further R5.16/litre in the petrol price, which is made up of 10 other components that largely cover the costs of storage, transportation, and margins for the retailers and wholesalers of petrol. However, as hard as they have tried in the past, the authorities have been unable to reduce these minor levies, managing only to contain them as best they can. Fortunately, soon after Enoch Godongwana became the Minister of Finance, he realised the damaging impact of incessant increases to the General Fuel Levy and RAF Levy over the past two decades, putting a halt to these increases in 2022. Had he not done so, our petrol price would be around R1 more per litre today.

The accompanying graph shows us how the BFP component – which makes up around half (48%) of the total price of petrol over the past decade – has fluctuated, largely due to changing oil prices. During the year of 2020/21, when demand dropped at the height of the Covid-19 pandemic, the average price of Brent Crude oil was around US$41/barrel. This, in turn, reduced our petrol price from an average of R16.16 the prior year to R14.65/litre, despite the average rand/dollar exchange rate of R16.49:US$1 (13% up on the previous year). This gives one a clear indication of the influence of international geo-political forces on our petrol price.

The graph also shows how the international oil price escalations that began in 2021/22 – taking Brent Crude from US$65 to US$96/barrel (with an average of US$76.38 for that year) – pushed our petrol price above R20/litre and have kept our petrol prices fluctuating above the R23/litre mark on average each year since then.

The recent few months’ reduction in the price of petrol from a high of R25.49 in May this year to R21.05 in October has largely been due to a combined strengthening of the rand (by 6.5%) and the lower oil price (down by 17%), which has reduced the BFP component of our petrol price to below R10/litre for the first time since February 2022.

Current tensions in the Middle East between Iran and Israel could very well reverse these gains and our petrol price could escalate back up to R23-R24/litre in a short space of time.

Should government take meaningful action to remove the two biggest levies and tax components, the General Fuel Levy and the RAF Levy, this would have a marked impact, reducing the price of petrol and diesel by around R6/litre. However, the government would need to increase the rate of taxes in one or more areas of VAT and PAYE to make up for the R130 billion to R140 billion per annum lost to Treasury as a result of this decision.

Given our current state of affairs, the only other way we could manage such a drastic reduction in taxation would be to remove the wasteful expenditure caused by maladministration and corruption throughout all levels of government, combined with trimming the fat of a bloated administration… something that is hardly likely to happen in the next few years.

Published by

Focus on Transport

focusmagsa