South African economy under threat

South African economy under threat

Freight transport volumes are a reliable barometer of the level of economic activity in industries or countries. NICK PORÉE warns that the freight logistics industry is becoming the most visible symptom of South Africa’s unrealistic economic policies.

The near collapse of railways, inefficiencies of ports, and now the rapidly escalating barriers to road freight are having negative impacts on the economy. Due to the reliance on road transport, the current activities of ill-defined and illegal forums are threatening the entire logistics system of the country.

Although the protestors continually harp on about the employment of foreign drivers, the real issue appears to be that the All-Truck Drivers Forum and Allied South Africa (ATDF and ASA) want to be recognised as a union and to influence wages and conditions of service negotiations throughout the trucking industry. These two parties have previously been blamed for similar acts of economic sabotage but have not been forced to reveal their membership, leadership, or the basis for their alleged mandate. Neither have they been curbed by effective policing, nor penalties for the massive losses suffered by industry.

The forums are using as the basis for their actions the concept of the National Economic Development and Labour Council (NEDLAC) centralised bargaining for regulated wages and conditions of service. Mandatory application of these conditions to smaller businesses is a primary reason for the general reduction of business activity, unemployment, and the global lack of competitiveness of most South African industries. Much road transport is performed by small firms, including a number of regional operators, while over 60% is by own-account truck owners, who do not fall under the ambit of the transport bargaining council but are part of many other industries.

The incompetent government structures are in disarray trying to placate this nebulous subversive movement, which relies on avoiding penalties by having no fixed structures and denying responsibility. The road transport industry is equally nebulous, with no effective regulation of commercial transport. There is no record of registered operators or their vehicles, drivers, premises, or management, unlike in all developed countries. The industry operates in an unstructured jungle of garbled regulations, applied by predatory enforcement agencies. This is due to the failure to introduce an effective international commercial transport regulatory system when road transport was deregulated. The necessary corrections were described in the Road Freight Strategy approved by Cabinet in 2017… but were never implemented.

The Department of Transport (DoT) is totally disconnected from the realities of the road freight industry as evidenced by the number of regulatory failures, blunders, and obfuscation which impede the industry due to the inefficiency of the department and its agencies. The conflation of road traffic regulation and commercial road freight transport in the constitution splits the regulatory responsibility between the DoT and the nine provinces. This is further aggravated by the DoT’s devolution of activity (or inactivity) to the Road Traffic Management Corporation (RTMC), Cross-Border Road Transport Agency (CBRTA), and Road Accident Fund. The RTMC has failed to achieve any of its 10 basic foundational mandates in its 20 years of existence, while the CBRTA still exists to issue exit tax permits despite the decisions of the Southern African Development Community (SADC) and Tripartite to scrap these permits in 2012. The RFA is allegedly in debt for billions of rands, eight successive Ministers of Transport have failed to address the problems, and the regional freight transport industry is equally disorganised.

On the international scene, the World Bank’s US$750 million loan aims “to put the country on a more resilient and inclusive growth path by leveraging South Africa’s strength to mitigate the effects of the Covid-19 crisis through their strong social safety net and by advancing critical economic reforms”. Marie Françoise Marie-Nelly, World Bank country director for South Africa, says, “This financing builds on our new World Bank Group Country Partnership Framework (CPF) 2022 – 2026, jointly developed with the government in July 2021, to help stimulate investment and job creation.”

The de facto situation is that the funding is merely supporting the government policy of retaining power through dependency on inflated salaries and social grants. The World Bank’s goal to “leverage South Africa’s strength” (what strength?) and “stimulate investment and job creation” fails to recognise the lack of capacity in government at all levels and the impact of this on commerce and industry. The current government’s intentions to initiate Employment Equitylabour regulations, the growing social grant liability, the desultory progress of the National Infrastructure Plan, Operation Vulindlela, failed agricultural policy, and failure to restructure the expensive and ineffective state-owned enterprises (SOEs) are all factors inimical to business creation and private investment.

The virtual collapse of Transnet railway and ports is a further drag on the economy, causing a massive surge in road haulage of bulk commodities and congestion and inefficiency at ports. In the road freight cross-border trade via South African borders, clearing times in the last week averaged around 27 hours. As a result, the total delay cost for the week increased from R643 million to an estimated R726 million per week, according to the BUSA Weekly Cargo Report of June 17. Afgri’s May newsletter reported that losses in the export of South African table grapes have increased five-fold because of bottlenecks in the country’s ports, taking a toll on insurers still willing to underwrite risk in this sector of perishable cargo. Afgri also highlighted further warnings that there is a looming probability of large areas and sectors of business becoming uninsurable due to the incapacity of authorities to respond to crime, fires, water failures, and the condition of infrastructure. No one invests where there is no insurance.

BUSA’s report states that the SOE’s impacts on the economy are evident, while containerised trade is standing still (or even going backwards). Consequently, and most importantly, only sustained growth in our national economy spilling over into containers will offset this trend. This change will require ongoing investment and accelerated private sector participation in our supply chain and, specifically, our ports, together with a coordinated drive to link all the different nodes of the logistics network into a workable solution.

As has been the case for the last ten years, our regional competitor ports (such as Beira, Dar-es-Salaam, Maputo, and Walvis Bay) have been making significant strides by promoting private investment and management as suggested above, while South Africa has been standing still. All too often, we hear the refrain of poor equipment maintenance and procurement, system failures, and lack of capacity building. We need to turn all of these elements around to succeed, with the fully functioning port and hinterland structures for which South Africa was known in the not-too-distant past.

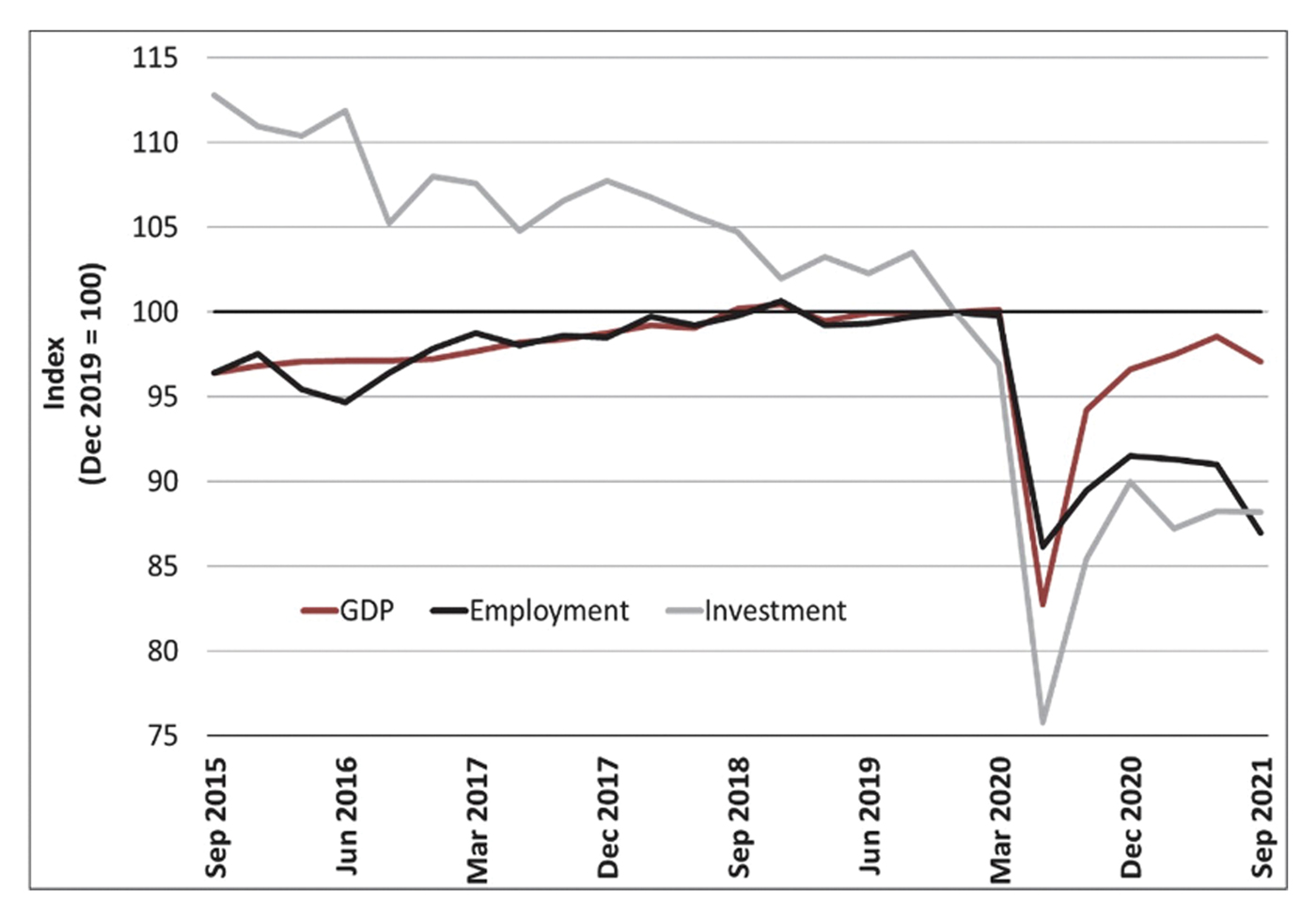

It is futile for international agencies to continually throw mega-borrowings of dollars at problems whilst expecting incapable government structures to make commercially relevant plans and decisions. More of the same restrictive and ineffective government policy means that business will continue to respond to the barriers to investment caused by ineffective infrastructure, unrealistic and uncommercial planning, social regulation, and predatory pricing of administered costs. The results of the current economic and social policies are evident in South Africa’s 2022 Treasury Report and are illustrated in the accompanying graph.

South Africa: Employment, Investment, and GDP (2015-2021)

Source: Statistics South Africa

The conclusion from the National Treasury is that “accelerated implementation of reforms is necessary to create jobs and encourage investment over the medium term”. Failure to act will see further unemployment as businesses close or relocate to more equitable countries. Twenty years of the current policies have created the need for urgent action. It is essential that industry structures are coordinated to support the necessary political changes to implement an efficient government at all levels. The key issue is a competitive business environment freed from excessive restrictions on investment. This is essential if the country is to achieve economic growth to support the rapidly increasing population.

In the transport and logistics sectors, the warning signs are clear: rapidly increasing costs, deteriorating efficiency, and social barriers will strangle attempts at economic development and deter investment in agriculture, industry, and trade.

Published by

Nick Porée

focusmagsa