Is diesel dead?

Is diesel dead?

Busworld Europe 2025 – the world’s largest bus and coach exhibition – left little doubt about the direction in which the global bus industry is heading. CHARLEEN CLARKE says the message was clear: the bus of the future is electric, connected and digitally managed.

This year’s Busworld – which sprawled across more than 82,000m2 of exhibition space – attracted over 550 exhibitors from 40 countries. A total of 45,427 visitors from 101 countries (including 405 journalists) travelled to the fair, with a strong contingent coming from Africa.

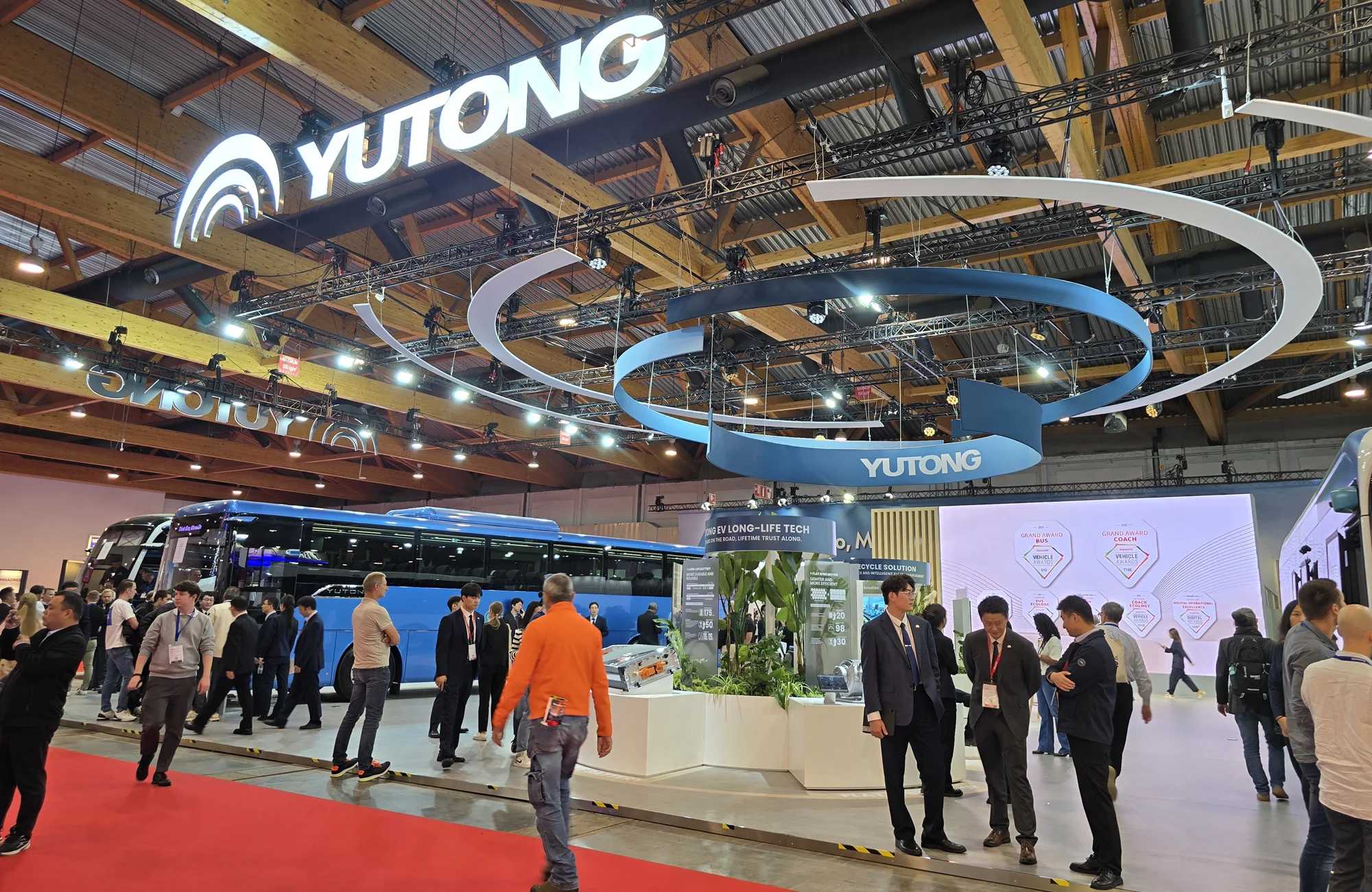

Those visitors soon observed the dominant theme at Busworld 2025: electrification – not just as a concept, but as a commercial reality. The European bus and coach industry is no longer asking if it will decarbonise, but how fast and how sustainably it can do so. Accordingly, nearly every major manufacturer, from MAN, Mercedes-Benz and BYD to VDL, Otokar and Yutong, showcased new-generation electric or hydrogen buses.

BYD used the event to unveil two new intercity models – the B12.b HF and B18.b – with expanded range capabilities and faster charging times.

Daimler Buses held the world premiere of the Mercedes-Benz eIntouro, its first fully electric intercity bus. This new model is based on the familiar diesel Intouro but features a battery-electric drive and is designed for intercity routes, school bus services and short holiday trips. The eIntouro is available in two lengths (12.18m and 13.09m) and offers a range of up to 500km. Daimler Buses also revealed a new NMC4 battery generation for its eCitaro, signalling a step-change in energy density and lifecycle efficiency. Daimler Buses plans to have battery-electric touring coaches in its portfolio by the end of the decade.

Vietnamese newcomer VinFast made its European debut with the EB8 and EB12, underlining how global the zero-emission movement has become. Hydrogen and fuel-cell technologies also featured, though they remained fewer in number compared to battery-electric vehicles, which clearly dominated both the show floor and the conversation.

MAN Truck & Bus unveiled the Lion’s Coach 14 E, the world’s first fully electric coach from a major European manufacturer. Its launch marked an important milestone for the industry, signalling that electrification is no longer confined to city buses, but is advancing into longer-distance passenger transport.

The Lion’s Coach 14 E is a 13.9-m, three-axle vehicle built on MAN’s proven diesel platform, but re-engineered around a dedicated e-mobility architecture. The drivetrain technology is derived from MAN’s electric truck range, supported by NMC battery packs produced in-house at the company’s Nuremberg plant. Depending on configuration, battery capacity ranges from 320 to 480kWh, with some reports suggesting up to 534kWh, delivering a claimed range of around 650km under optimal conditions. In passenger configuration, the coach can accommodate up to 63 people, offering a genuine zero-emission alternative for intercity and long-distance services.

Design refinements also play a crucial role. MAN’s engineers have focused on aerodynamic efficiency, lowering the drag coefficient while maintaining luggage space equivalent to that of the diesel version. The result is a coach that looks familiar but performs with a new kind of quiet precision – one that reflects both engineering continuity and technological ambition.

Production of the Lion’s Coach 14 E is scheduled to begin in 2026 at MAN’s Ankara plant in Turkey, following its conversion for electric vehicle assembly. The company is expected to position the model as a practical, real-world option for operators seeking to decarbonise longer routes without compromising passenger comfort or reliability.

What makes the Lion’s Coach 14 E significant is not only its specification, but also what it represents. Electric coaches have long trailed city buses in terms of commercial readiness, largely because of battery weight, cost and range constraints. MAN’s entry into this field changes that dynamic, bringing credibility, service infrastructure and scale to a segment that has awaited a breakthrough. By combining proven truck-based electric technology with established aftersales networks, MAN has delivered a vehicle that is as much a business case as a statement of intent.

The industry’s pivot away from diesel is happening faster than expected. According to Busworld’s own congress data, by 2030 more than 60% of urban buses in Europe will be battery-electric, underscoring the pace of transition.

Integration over isolation

A striking shift at Busworld 2025 was the way in which component suppliers positioned themselves. Gone are the days when a company could showcase a single motor or battery. This year, the focus was squarely on systems integration – full suites combining batteries, inverters, cooling systems and software control under one ecosystem.

ABB, for example, exhibited an integrated traction battery-motor-inverter package, designed to simplify OEM assembly and improve efficiency. Thermal management, a crucial factor in electric vehicle range and reliability, drew strong attention too. Suppliers demonstrated new approaches to air conditioning and heating that preserve battery range, rather than draining it.

Software and diagnostics also took centre stage. Battery management systems, predictive maintenance tools and digital twins were presented as essential parts of the next generation of buses. Even retrofit specialists – those converting diesel fleets to electric – highlighted modular solutions, giving operators a lower-risk bridge to zero emissions.

Shifting the manufacturing map

Busworld 2025 didn’t just show new technologies – it showcased a new geopolitical balance of bus manufacturing. Turkey emerged as the leading country in terms of exhibitors with 107 participants, while China had 85 exhibitors, overtaking Germany’s 68. This redistribution of manufacturing strength is reshaping the global supply chain. While European OEMs still lead in brand heritage, design and safety systems, Asian and Turkish manufacturers are aggressively competitive on cost and production scale.

Policy, regulation and the new mobility framework

Parallel to the exhibition, the Busworld Congress hosted policymakers, industry associations and technology experts to discuss the legislative frameworks underpinning the transition to zero-emission transport.

The International Road Transport Union (IRU) played a prominent role, leading sessions on driver shortages, decarbonisation of long-haul operations and the harmonisation of European regulations. Across the panels, one sentiment stood out: the transition cannot be left to technology alone – policy and funding alignment are the real accelerators.

For operators, this reinforces the need to engage in dialogue not only with OEMs and suppliers, but also with regulators and municipalities. As one panellist noted, “It’s not enough to buy an electric bus; you have to be part of an ecosystem that charges, maintains and regulates it.”

Of course, it goes without saying that South Africa faces similar imperatives. Until the country has clear frameworks in place for charging infrastructure, grid capacity, or import duty incentives, electrification risks becoming a niche rather than a norm.

Real-world economics: From green hype to hard numbers

While Busworld has always been a stage for future-looking ideas, this year’s tone was refreshingly practical. Booths and presentations revolved around total cost of ownership (TCO), uptime and maintenance strategies, not just carbon reduction.

Manufacturers now know that fleet operators are scrutinising the economics: how fast does the battery degrade, how quickly can a depot recharge and what’s the residual value after eight years? The answers to these questions will determine purchasing decisions more than glossy sustainability promises.

Interestingly, hybrid systems made a modest comeback. DAF presented a mild-hybrid solution combining combustion and electric assistance, offering up to 15% fuel savings. Such technologies may still play a transitional role in regions where full electrification remains constrained by infrastructure.

Passenger comfort and digitalisation: The human touch

Passenger experience was another defining theme at Busworld 2025. With buses competing against personal vehicles, trains and low-cost airlines, comfort has become a strategic differentiator.

Exhibitors showcased quieter cabins, improved ergonomics, advanced lighting and infotainment systems designed to enhance the on-board experience. Meanwhile, safety and driver assistance technologies – Advanced Driver Assistance Systems (ADAS), geofencing and remote diagnostics – have become standard offerings rather than premium extras.

Mercedes-Benz highlighted the eCitaro’s new Comfort package, which won the “Comfort Bus” award, while Setra’s S 515 HD was recognised both for safety and comfort in the coach category.

Recognising innovation and design

The Busworld Vehicle Awards once again celebrated excellence, with a jury of 30 international experts assessing vehicles across 12 categories.

The top honours went to Yutong, which claimed both the Bus and Coach Grand Awards for the Yutong Bus U15 and the Yutong Bus T14E respectively.

Labels of Excellence were also handed out:

- Safety Coach: Setra S 515 HD

- Comfort Coach: Setra S 515 HD

- Ecology Coach: Otokar e-Territo 13 and Yutong IC12E

- Safety Bus: Yutong U15

- Comfort Bus: Mercedes-Benz eCitaro

- Ecology Bus: Yutong U15

The new Vehicle Design Awards added a fresh layer, celebrating visual and ergonomic innovation. The winners were VDL Bus & Coach – Futura 3 for Design Coach and Yutong U15 for Design Bus, with the Mercedes-Benz eCitaro and BYD B13.b named runners-up.

An honourable mention went to the UNVI C26, a futuristic concept vehicle that drew attention for its sleek, autonomous-ready design.

These results reaffirmed that the frontier of innovation now lies in marrying sustainability with user appeal – efficiency alone is no longer enough.

Lessons for South Africa

South African fleet operators who visited Busworld 2025 would have observed that electrification is no longer a European luxury or “nice to have” – it is a competitive necessity. The technology is proven, the infrastructure is scaling and the economics are beginning to make sense.

But rolling out a fleet of electric buses isn’t without its challenges. Charging networks need to be developed alongside route planning; partnerships between municipalities, utilities and OEMs will determine success.

South Africa’s energy context – with grid instability and regional variation – suggests a potential role for hybrid or hydrogen solutions in the medium term. Policy engagement will also be key: subsidies, carbon tax relief and energy tariffs could make or break the transition.

Critically, investments in skills will need to match the investment in hardware. As one European OEM executive put it during a panel session, “Zero-emission buses don’t just need chargers; they need champions who understand how to run them.”

So, will we see those zero-emission buses on South Africa’s roads? Busworld more than demonstrated that the technology is ready. What’s needed now is the will, the infrastructure and the government support to put them on the road.

Published by

Charleen Clarke

focusmagsa