Hyundai: Hooked on hydrogen?

Hyundai: Hooked on hydrogen?

All over the world, truck producers are launching battery-electric trucks. South Korea’s Hyundai Motor Company, on the other hand, is doggedly pursuing fuel cell technology for its heavy commercial vehicles. CHARLEEN CLARKE travels to Hwaseong in South Korea to find out why.

It’s 6.30am when I arrive at Hyundai’s enormous headquarters in Seoul, South Korea – which is a somewhat unusual time to arrive for a meeting in most countries. Not in Seoul, of course, where insanely long working days are as common as kimchee.

A proliferation of tech is also not unusual here (South Korea was the first country to launch a nationwide 5G network), but Hyundai appears to be taking tech to a whole new level. There is even a robot in reception that serves ice cream – no kidding!

But I am not in Seoul to test ice cream. I’m here to meet the brains behind the company’s Xcient fuel cell truck and take a spin in the vehicle. I’m also hoping to gain an insight into the company’s obsession with fuel cell technology. All this necessitates a drive to the Hyundai Namyang Research and Development Center. One of the largest automotive R&D centres in the world, it is located in Hwaseong, Gyeonggi Province. It’s a mere 50km away, but it could easily take two to three hours to get there thanks to Seoul’s insane traffic.

We get lucky, making the trip in just under two hours. At the visitor centre, my equipment (laptop, camera, phone) is scrutinised. The camera isn’t allowed into the facility due to security reasons. The camera on my phone is also blocked with security tape. “This is a high-security centre,” a guard tells me, stating the rather obvious. I get it: Hyundai is one of the most innovative automotive companies on the planet, and this is the birthplace of most of its future technologies. As such, what happens here is top secret.

Ironically, though, I’m not here to take a look into the future. Instead, I want to understand the company’s current strategy. The company has invested heavily in the Xcient fuel cell truck; to date, fuel cell electric vehicles (FCEVs) – especially in the heavy-duty segment – have emerged as Hyundai’s sole solution to reducing emissions and decarbonising the logistics industry.

Meanwhile, most of the other leading truck makers have been investing billions in battery-electric vehicles (BEVs), saying that the costs of fuel cells, hydrogen tanks, and refuelling infrastructure mean that BEVs are the most cost-effective option when considering total cost of ownership (TCO). Electric drives are less maintenance intensive than hydrogen vehicles, with their fuel cells and gas tanks. BEVs also have an advantage in terms of energy efficiency. According to industry experts, with BEVs, 75% of the energy flows into the drive, while with FCEVs this drops to 25% – making hydrogen trucks considerably less efficient.

Furthermore, hydrogen costs are high. To achieve cost parity with BEVs, the price of hydrogen would need to be around €3.10/kg. The forecast for 2030, however, is between €5.00 and €7.50. Which begs the question: why is Hyundai so besotted with hydrogen?

Leading the market

Before we dive into the technology, it’s useful to understand Hyundai’s place in the commercial vehicle (CV) landscape, particularly in South Korea, where domestic manufacturers dominate the market. According to data provided by Hyundai, the number of newly registered trucks (GVM 4.9 to 40t) in the country has averaged around 31,000 units over the past 10 years.

Hyundai has been engaged in the CV business since the late 1960s, and has been leading the domestic CV market “for years”. The domestic truck market is fairly unique, in that the majority of drivers are owner-drivers, classified as individual business owners. As is typically the case in many markets around the world, their most important considerations include TCO, driver comfort, fuel efficiency, maintenance, and profitability.

The company offers a full lineup of CVs, from light- to heavy-duty trucks (GVW 3.5 to 40t), vans, city and intra-city buses, and purpose-built vehicles. Half of Hyundai’s volume goes into overseas markets, and its CVs are sold in about 130 different countries, including South Africa. Like most other CV manufacturers, Hyundai is focusing on the transition towards zero-emission vehicles but – when it comes to heavy-duty trucks – it has nailed its flag to the fuel cell mast.

Why hydrogen?

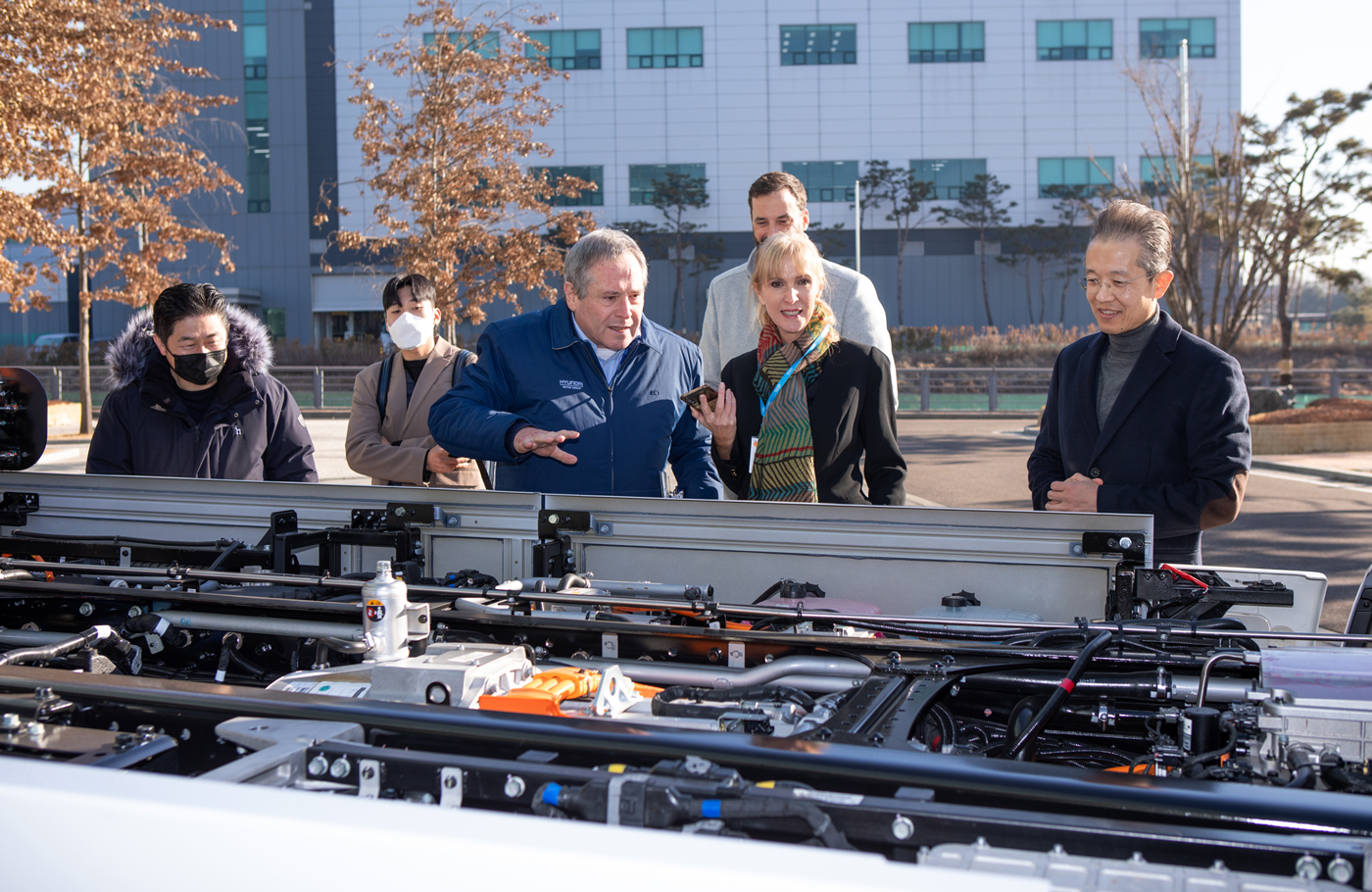

Hyundai views hydrogen as the optimal energy source for long-haul trucking and commercial logistics – but why? During our visit to the Hyundai Namyang Research and Development Center, we meet with Mark Freymueller, senior vice-president of the global commercial vehicle business at Hyundai Motor Company, and it’s clear that he believes in the merits of FCEVs over BEVs – given certain provisos.

“I’m not trying to bash BEVs,” he stresses. “But you need to look at range and – even more importantly – how long it takes to get back to that range during recharging or refuelling. With fuel cell technology, it’s about eight to 20 minutes, depending on circumstances, such as ambient temperatures. Let’s say 15 minutes, versus a couple of hours for battery.

“Now you can say that megawatt chargers will get a BEV to 80% within just half an hour. I have had discussions with some owners of BEVs, and they’re perfectly fine with that. I’m going to be the last one to try to convince them to throw away their BEV and replace it with a FCEV. After all, it’s a great solution for them and CO2 has been saved, so I’m all for it,” he continues. “But there’s a huge difference if you just charge one truck versus the charging of a fleet of 100 or 1,000. What about the stress on the grid and the amount of power you need to charge 100 trucks?”

Ultimately, Freymueller believes that in certain cases, the better option is clear. “The heavier the vehicles, the more payload they need, and the more range they need, the more fuel cell makes sense. That’s why, for new countries, new markets, or new regions, we’re not even trying to get in there with diesel trucks. We are purely focusing on fuel cell,” he says.

Does this mean that other truck manufacturers are making a mistake in developing BEVs? “I don’t know if it’s a mistake; maybe it makes sense for some operations,” responds Martin Zeilinger, executive vice-president and head of the commercial vehicle development tech unit at Hyundai Motor Group. “BEV is suitable for shorter haulages and lighter freight. When we’re talking about vans and last-mile deliveries, battery-electric is not a bad choice because you can share technology with passenger cars – which means super high volume and low cost. But the more you’re coming to heavy-duty and longer haul, the more the fuel cell makes sense,” he reiterates.

Hyundai certainly believed the fuel cell made sense back in 2020, when the company shipped the first 10 units of the Hyundai Xcient Fuel Cell – the world’s first mass-produced fuel cell heavy-duty truck – to Switzerland. “Hyundai will roll out 50 trucks this year and a total of 1,600 units by 2025. The Xcient Fuel Cell will help decarbonise the world,” a press statement said at the time.

That hasn’t quite happened. Currently, a total of 48 Xcient Fuel Cell trucks are in operation in Switzerland, while there have been reports in the media that the project will grind to a halt. But Freymueller describes the rumours as “nonsense”. “There is a very clear commitment on the part of all the partners involved that we will keep on building up the infrastructure and extending the hydrogen production. From our side, there’s a clear commitment that we will bring the trucks into Switzerland. There was never a point when we thought about stopping,” he stresses. This is also confirmed in a separate interview (see the sidebar: “No plans to jump ship”).

Freymueller is, however, candid when he says that the Switzerland project hasn’t exactly gone according to plan: “With the energy crisis, electricity prices have skyrocketed. Obviously, this had an impact on us. Long story short, did the energy crisis put a dent in our plans of developing the market? Yes, of course. Have we changed our plans? No.”

While the fleet of trucks isn’t as large as envisaged, it has notched up some impressive achievements. For instance, in June this year the Xcient fuel cell trucks surpassed a cumulative driving distance of 10 million kilometres. The trucks, which run on green hydrogen, have achieved a significant reduction in carbon emissions (a fleet of regular diesel trucks would emit approximately 6,300 tonnes of CO2 over the same distance). This reduction is estimated to be equivalent to the amount of carbon absorbed annually by approximately 700,000 pine trees, or the creation of a pine forest covering 508 hectares (around five million square metres).

The challenges of a global rollout

While the project in Switzerland has been relatively successful, rolling out hydrogen-powered trucks on a global scale comes with significant challenges, as the company has discovered (Xcient FCEVs are now being sold in the US, Switzerland, Germany, France, Netherlands, New Zealand, Korea, Israel, Saudi Arabia, and the UAE). The most immediate and obvious issue is infrastructure: unlike electric charging stations, which are growing in number, hydrogen refuelling stations remain sparse and underdeveloped in many regions.

“Our trucks are worthless pieces of metal if there’s no hydrogen refuelling infrastructure,” admits Freymueller. “So, when we bring a fuel cell truck into a new country or region, we must have a holistic approach. This does not necessarily mean that we have to produce the hydrogen or build up our own infrastructure for refuelling, but we need to make sure that we have partners to work with us right from the start, and we need to establish this ecosystem – because we are at the forefront. Pioneering is a challenge, because when it comes to fuel cells, we’re paving the road for everyone else by building up the infrastructure.”

This approach has worked extremely well in Switzerland, where numerous partner companies and even arch-rivals (the truck operators) are working together to make FCEVs a reality, with the operators running the trucks on a pay-per-use basis.

But building a hydrogen infrastructure is no small feat. Each region poses unique challenges, from regulatory barriers to logistical complexities. In the US, Hyundai has taken a proactive approach by deploying trucks in areas like California, where the hydrogen refuelling infrastructure is more advanced. Still, it’s clear that widespread adoption of hydrogen trucks will require significant investments in infrastructure development, something Hyundai is working on alongside government agencies and industry partners.

“In the past couple of decades, it was easy if an OEM decided to enter a market. After all, there’s a diesel refuelling station everywhere. The introduction of fuel cell vehicles is a much more complex situation,” points out Freymueller. During the rollout of the infrastructure, hydrogen refuelling stations cannot be a dime a dozen – and therein lies the challenge. “If you have an issue with a hydrogen refuelling station, the next refuelling station may be 40 or 50km away. In Switzerland, we had an issue with one refuelling station for a couple of days because they paved the road, so you could not access the station. If you’re talking gasoline or diesel, it doesn’t make a difference… you just go to the next one, which is probably 2km away. With hydrogen, this can ground your fleet. So, the reliability and easy accessibility of the infrastructure for refuelling is really, really important. In Switzerland, we’ve had no issues with the trucks; the only issues we’ve had were with the infrastructure,” he says.

Another challenge is cost. Currently, hydrogen is more expensive than diesel or electricity, making it less attractive for many logistics companies. This isn’t necessarily a deterrent in all markets, though. “In Switzerland, for example, we have been able to meet cost parity with diesel trucks right away. This is thanks in part to government road tax exemptions for zero-emission vehicles,” reveals Freymueller.

As he notes, however, Switzerland is “a very specific situation where diesel is relatively expensive”. “The same applies to much of Europe. If you compare those costs to Saudi Arabia, where a litre of diesel costs a mere 28c… it’s going to be more difficult to meet cost parity there,” he admits.

However, Hyundai believes that as the scale of hydrogen production increases, costs will come down. In order to bolster this, Hyundai is developing megawatt-scale polymer electrolyte membrane (PEM) electrolyser manufacturing capabilities for green hydrogen production.

Perhaps, as Zeilinger points out, the current obsession with cost is misplaced. “What is the ultimate goal? Is it only about cost? That is only half the truth. What we are doing is reducing global warming,” he emphasises. “If you look at what fossil combustion contributes to our environment globally, with global warming and all our climate disasters we are facing around the globe, if you put all that cost into the equation holistically, then diesel is not as cheap as it looks. And if we believe that we need to reduce global warming, then emission-free driving with regenerative energy has to be the ultimate solution.”

But surely the costs of zero-emission trucks should come down? “Yes,” Zeilinger responds. “But, right now, isn’t diesel too cheap? After all, crabs are fished in the Baltic Sea, then they are carried down to Morocco to be hand prepared. Then they are shipped back to the marketplace. Transportation is incredibly and stupidly cheap, and then, as a result, we have pollution. We keep on saying that the cost of fuel cell or alternative transportation must come down – but maybe the diesel costs should rise.”

Freymueller agrees. “This will happen. There will be CO2 penalties for using diesel. So, the operation of a diesel truck will go up and the operation of a zero-emission truck will come down, and they will meet at one point. Irrespective of this, money invested in zero-emission transport is money well spent because, at the end of the day, it’s going to be cheaper for the overall community,” he reiterates.

But should that zero-emission truck really be a FCEV rather than a BEV? Freymueller believes the question is moot: “It’s about saving CO2. If it’s done by battery or by fuel cell, I don’t care really, because both technologies are there for a reason – and they will stay.”

Zeilinger concurs: “Both vehicle technologies are available. If you ask, ‘are we betting on battery-electric?’, the answer would be ‘no’; strategy-wise, we are going fuel cell. If, for some markets or niches, we find that there is a requirement for BEV, we can easily adapt our products, because we have the technology from our buses and light-duty trucks, and it is well proven.”

The power of partnerships

Indeed, Hyundai is targeting sales of two million EVs (largely cars) by 2030. Earlier this year, long-time partners Hyundai Motor Company and the Iveco Group signed a Letter of Intent, reinforcing their cooperation “with a forward view towards electric heavy-duty truck solutions, including both battery-electric trucks and fuel cell electric trucks, for European markets”.

On this note, both Freymueller and Zeilinger emphasise that collaboration is no longer optional in the CV game; it is essential in order to navigate the challenges of a transport industry undergoing rapid evolution driven by advancements in technology, regulatory changes, and a global push toward sustainability. As Freymueller explains: “Let’s take the rollout of FCEVs as an example. You cannot build up the required infrastructure, or an ecosystem, without partners. Somebody has to build up the infrastructure; somebody has to produce the hydrogen and transport it…”

With over 35 years of experience in the industry, Zeilinger shares a similar perspective, noting that technological advancements in areas like autonomous driving and electrification have dramatically increased the complexity of the sector. “If you look around our industry… no single OEM is doing autonomous by themselves,” he says, emphasising the magnitude of the investment required for these innovations. According to him, partnerships allow companies to pool resources and expertise, making it possible to tackle challenges that would be insurmountable for any one company to handle alone.

The shift toward more environmentally friendly technologies, such as electric and hydrogen fuel cell vehicles, has introduced additional layers of complexity that make collaboration even more crucial. As Freymueller points out, the focus has shifted from traditional OEM-driven topics to areas like connectivity, sustainability, and autonomous driving.

In the past, companies could rely solely on having their own tech to survive, but now, start-ups and disruptive innovators are introducing fresh ideas that require established companies to embrace collaboration. “You have many more disruptive start-ups coming along… to embrace that in partnerships is, I think, mandatory for every OEM right now,” says Freymueller.

Zeilinger adds that the introduction of active safety systems, such as ABS and ADAS, marked a significant leap in vehicle technology, but the current challenges posed by autonomous driving and zero-emission transport represent a new level of complexity. As he explains, “Electrification and emission-free and autonomous [driving]… require another magnitude of investment.”

Again, for companies to meet these challenges, forming partnerships is essential. Despite the potential risks of sharing intellectual property, both Freymueller and Zeilinger see partnerships as a strategic investment. “You form partnerships, looking for complementarities – not for direct competition,” Freymueller says. Zeilinger expands on this, framing the sharing of technology as an opportunity rather than a threat: “Maybe there is an active sharing of some technologies… but it’s an investment in such a partnership… it’s broadening.”

The idea is that collaboration creates value that exceeds what any company could achieve on its own. Freymueller compares this dynamic to a personal relationship: “You don’t get anything out of a partnership if you’re not giving anything into that partnership… what’s coming out of that is bigger than everyone acting individually.”

What does the future hold?

Looking ahead, Hyundai has ambitious plans for its fuel cell technology. By 2030, the company aims to produce 500,000 hydrogen-powered vehicles. While Europe and the US remain key markets, Hyundai is also looking to expand into other regions, including the Middle East, Australia, and New Zealand.

Hyundai’s hydrogen solutions go beyond passenger cars, trucks, and buses to include trams, special equipment, vessels, power generators, and advanced air mobility. Furthermore, while BEVs may currently dominate the zero-emission passenger car market, Hyundai sees fuel cells as the future for CVs, particularly in heavy-duty applications.

So, is Hyundai hooked on hydrogen? Absolutely, but it’s not just an obsession; it’s a calculated bet on a future where hydrogen plays a key role in decarbonising heavy-duty transportation. Whether or not Hyundai’s vision will come to fruition depends on a host of factors – from government policies to advances in technology. But one thing is certain: Hyundai appears determined to lead the way.

Driven: the Hyundai Xcient FCEV

During our visit to the Hyundai Namyang Research and Development Center, we took a quick spin in the Xcient FCEV. It is produced at Hyundai’s Jeonju Plant, which spans 103,000m² and has manufactured around a million trucks since 1995.

From the outside, the Xcient FCEV looks a bit like a blinged up version of the diesel equivalent. For instance, it has a distinctive mesh-type V-shaped grille with large apertures. This design is specifically engineered to maximise airflow over the fuel cell stack, improving the cooling performance so crucial for hydrogen fuel cell operation. The diesel truck, on the other hand, has a more conventional grille suited to cooling the internal combustion engine, without as much emphasis on airflow management as for fuel cells. The FCEV also has more pronounced LED headlamps and chrome-coated (rather than steel) wheels, giving it a more premium look.

Hopping into the Xcient FCEV, we soon feel right at home. While the seat is a tad too hard for our taste, the driver-oriented layout is designed to minimise hand and eye movement, reducing fatigue on long hauls. The eight-inch touchscreen infotainment system is intuitive, offering simple menu scrolling and feature selection. Every control is within easy reach. We like the haptic feedback system integrated into the steering wheel, which vibrates to warn the driver in dangerous situations (such as lane departures or the risk of collision).

The Xcient FCEV is equipped with seven hydrogen tanks, which collectively store around 31kg of hydrogen to power the vehicle’s two 90-kW fuel cell stacks. The claimed driving range is “over 400km” per charge. One of the most impressive aspects of this truck is its refuelling time, which ranges from just eight to 20 minutes. Its 350-kW electric motor delivers 2,237Nm of torque, which rivals some diesel powerplants in the same weight class. The truck is equipped with an automatic Allison transmission with five forward and one reverse gear, and the shifts were super smooth.

The truck also features a triple battery array that stores up to 72kWh of energy. For safety reasons, the hydrogen tanks have undergone stringent tests, including a 1.5-m drop test, as well as penetration and fire tests, to meet European safety standards. Speaking of safety, the Xcient FCEV is equipped with Vehicle Dynamic Control, Forward Collision-Avoidance Assist, Lane Departure Warning, Smart Cruise Control, and an Easy Hill Start system. In the event of an accident, the truck automatically shuts off power to the high-voltage cables and hydrogen tanks, minimising the risk of secondary incidents.

Behind the wheel, the Xcient FCEV offers a smooth and quiet driving experience – a stark contrast to the noise and vibration commonly associated with diesel trucks. However, the sensitivity of the brakes can take some getting used to, with initial stops feeling slightly abrupt. Despite this, the overall driving experience is good, and Hyundai has clearly put considerable thought into making the experience comfortable for drivers who spend long hours on the road.

Hyundai declined to provide any details on the price or warranty.

- While Hyundai has yet to introduce the Xcient FCEV to the South African market, the company is exploring potential opportunities, but it points out that establishing a hydrogen economy requires collaboration across the entire value chain (which is probably unlikely to happen in South Africa anytime soon).

No plans to jump ship

Unlike battery-electric vehicles (BEVs), which are widely available from most European OEMs, there is currently only one manufacturer globally that offers homologated and series-produced fuel cell electric vehicles (FCEVs) for commercial use: Hyundai. Despite speculation, the company has no intention of withdrawing from its fuel cell project in Switzerland, writes MARTIN SCHATZMANN, editor-in-chief of TIR transNews.

Hyundai expanded into the heavy commercial vehicle sector with its Xcient FCEV trucks in 2020, after gaining years of experience in the passenger car sector. Switzerland became the focal point of this initiative. Significant project milestones include the formation of Hyundai Hydrogen Mobility AG (HHM) – a joint venture with Swiss company H2 Energy – in June 2019, and the commencement of hydrogen production at the Niedergösgen hydropower plant later that year.

By autumn 2020, the first Hyundai FCEVs were delivered to Swiss transport companies. Today, 48 trucks are operating on Swiss roads. “We are very satisfied with the reliability,” says Beat Hirschi, CEO of HHM. “The magic lies in the configuration of the battery and fuel cell for heavy goods transport, and the Koreans have done a great job here.” If you include a good quarter of a century of experience with passenger cars, dating back to 1998, the South Korean manufacturer can now build on more than 300 million kilometres of fuel cell experience.

However, the project has not expanded as initially expected. The original plan aimed for 1,600 trucks to be in circulation in Switzerland by now. Various external factors, such as the pandemic, Russia’s war in Ukraine, and Europe’s changing energy landscape – including the closure of coal and nuclear power plants – have delayed progress. “We no longer have the same starting position we had in 2020,” says Hirschi. The rising cost of energy, especially hydrogen, has also impacted the project, making the trucks more expensive to operate than initially projected.

The restricted vehicle configuration options were another early limitation. Initially, Hyundai offered only a 4×2 wheelbase (19 tonnes) with a box body. The range has since expanded to include a 6×2 version (27 tonnes) with additional body styles – such as a tarpaulin and a swap body – and a choice of four different wheelbases for both axle configurations.

From the outset, expanding into other European markets was part of the HHM strategy. In April 2022, HHM Germany was established as a wholly-owned subsidiary, with Charles Cambournac as managing director. The service network in Germany has grown rapidly, with 15 dealers and 75 certified service mechanics now in place. Approximately 50 FCEVs have been delivered to German customers, with that number expected to double by the end of the year. These trucks have already covered over one million kilometres in Germany, in addition to the 10 million kilometres driven in Switzerland.

Hyundai FCEVs have also been homologated in France, with two vehicles now in operation in Paris in partnership with Bert You and Hyliko. Additionally, HHM has secured a partner in Austria, signalling its imminent market entry.

Despite the slower-than-expected expansion, Hirschi remains optimistic. “Things are moving forward, even if not at the pace at which we could supply vehicles,” he says. Hyundai’s commitment to the project is clear. It remains dedicated to fuel cell technology and its subsidiary, HHM, as the latter continues to drive market expansion across Europe.

Pictured together above, Hirschi (right) and Cambournac (left) are confident that the growing adoption of hydrogen as a clean energy source, coupled with the company’s ongoing efforts, will provide additional momentum in Switzerland and beyond. Other OEMs also see hydrogen and fuel cells as key components of the future energy landscape, and the increasing interest in hydrogen-powered transport reflects this belief. The message is clear: despite external challenges, Hyundai has no intention of jumping the fuel cell ship.

Published by

Charleen Clarke

focusmagsa