Corridors or Corridas?

Corridors or Corridas?

What do road freight corridors and a Spanish corrida have in common? A lot more than you would think. NICK PORÉE explains…

Road freight transport on Southern Africa’s corridors is full of players with conflicting objectives. It is something like the Spanish corrida – with the various authorities as the bulls and drivers as the patient mounts of the picadors, engaging the bull without ability to retaliate. In this case, however, there are a minimal number of toreadors, so the bull always wins. Despite the conditions suffered by the drivers, border delays are irrelevant to the bulls, as operators are the target and revenue collection is the key performance indicator for border efficiency. There are, however, sparks of humour; a driver recently texted the Federation of East and Southern African Road Transport Associations (FESARTA) from Kolwezi: “I think I have the world record, 24 days from Dar es Salaam.”

The cost of delays to the road freight industry can be measured with reference to the fixed cost per hour – sometimes called the “ownership cost”. This includes the purchase price of trucks, interest, any hire-purchase or finance charges, driver salaries, unrecovered overhead costs, and the lost opportunity costs of doing fewer trips per month. The current fixed cost for a seven-axle interlink combination is approximately R360/hour, depending on age and usable hours worked. This translates to a conservative US$20/hour (depending on the prevailing exchange rate).

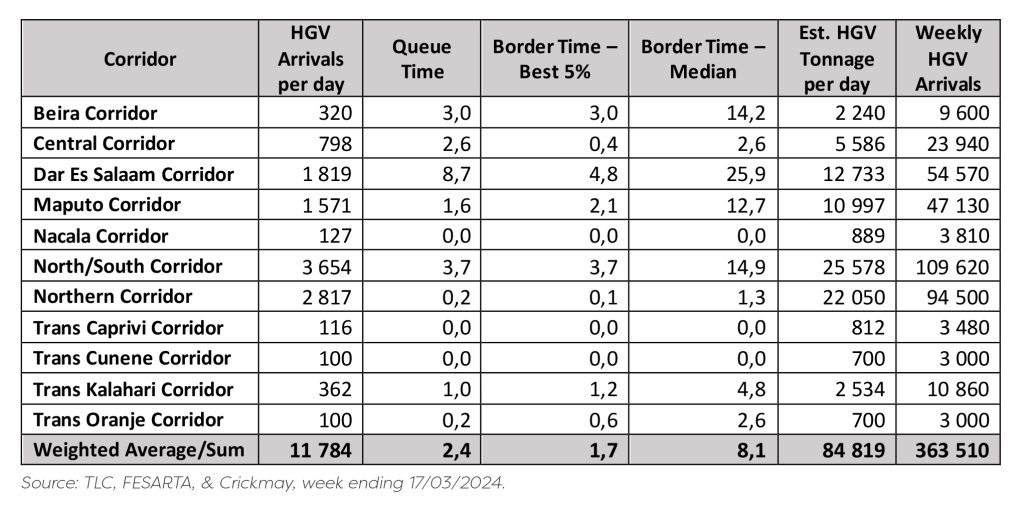

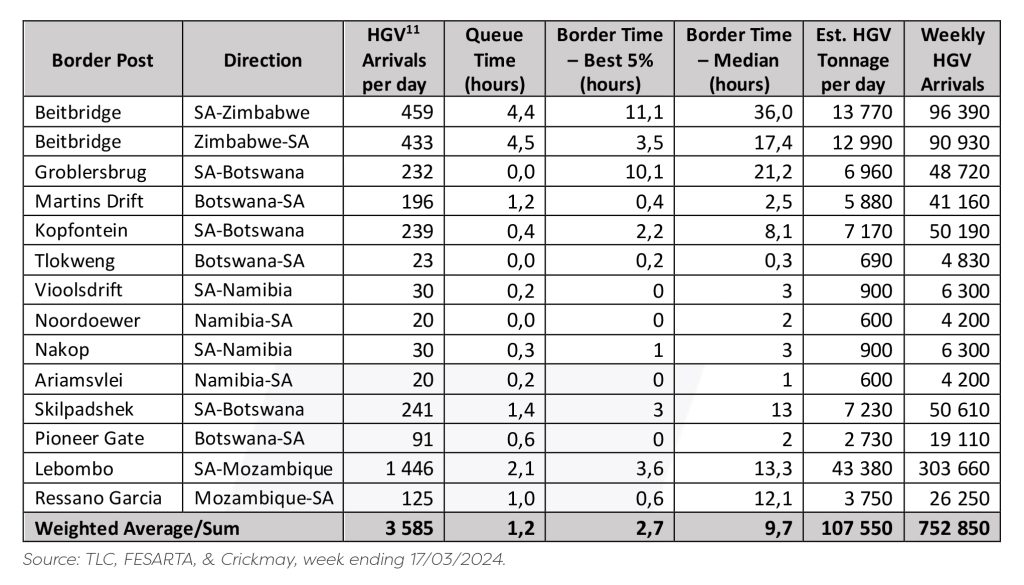

The situation on regional corridors and at South African borders is revealed by the satellite tracking and weekly reporting on the 11 major corridors of the sub-Saharan region by FESARTA and Crickmay and Associates for the SA Association of Freight Forwarders (SAAFF) and Business Unity SA (BUSA). The tracking system uses ringfenced partitioning of border installations, weighbridges, and roadblocks to analyse time and movements of commercial vehicles. The data, recorded in real time, gives complete coverage of entire corridors (Table 1) and each South African border (Table 2).

Using the data from the satellite tracking, it is possible to estimate the costs of the delays to the trucking industry.

The traffic flow across the 11 corridors is 363,510 vehicles per week with a median delay time of 8.1 hours. If we deduct a reasonable three hours per vehicle as an acceptable standard transit time, the delay cost at an average fixed cost of US$20/hour amounts to approximately $37,078,020/week. The annual cost to the transport industry is therefore about $1.9 billion. This does not include the costs to cargo owners when it comes to inventory, interest, lost production, deferred sales, and the reduction of productivity from the disrupted supply chain process. The transporters’ actual losses may well be double these figures.

For the South African border posts shown in Table 2, the worst delays are on the North-South Corridor at Groblersbrug and Beitbridge, as well the Maputo Corridor at Lebombo/Ressano Garcia.

It will be noted that the delay costs at South African borders are approximately three times higher than the 11 corridors in Table 1 ($100,881,900/week). The industrial cost may be twice the transport cost but, as the land borders are South African, much of the cost is incurred by industries in the countries inland from South Africa. The inefficiencies do, however, have an impact on the competitiveness of the South African regional import-export logistics chain, and the export competitiveness of local industry in regional and international trade.

It is noteworthy that the transit times at the New York-Ontario Peace Bridge border in North America are reported on the internet in real time and average 12 to 20 minutes. The costs and inefficiencies of our own supply chains are no doubt contributing to the very strong growth in the ports of the region, as Dar es Salaam, Beira, and Maputo are thriving, while ours are not. The costs are also probably negative for the future of the African Continental Free Trade Area (AfCTFA) being promoted by the African Union.

The magnitude of the continual wastage and economic destruction does not seem to be part of the much vaunted “logistics crisis”, which is receiving the attention of several committees. But the cashflow should provide motivation for concerted private sector engagement and profitable investment in measures to improve efficiency of border operations. Examples such as the public-private partnership build-operate-transfer (PPP-BOT) border developments at Beitbridge-Zimbabwe and the new Kazungula Bridge are designed to improve efficiency, but this will only happen if the country authorities stop talking bull**** and become sufficiently interested in the economic impacts to support the process of creating commercial efficiency.

If the road freight transport industry were better organised it could engage with the International Road Transport Union (IRU) to introduce the “transport international routier” (TIR) “carnet de passage” system, which contributes so effectively to trade in the northern hemisphere across all the different customs systems. The system, developed by the private sector IRU after World War II, is the most efficient multimodal method for performance of interstate trade, in all modes. It cuts out all the bull, by having all the facts in place and controlling illicit cargoes, whilst guaranteeing the revenue.

It does, however, require an industry organised into effective associations which consolidate advocacy and action. Where are the toreadors in the corrida…?

Published by

Nick Porée

focusmagsa