Are electric vans about to become cheaper than diesel?

Are electric vans about to become cheaper than diesel?

Electric vans – once seen as a futuristic luxury – are fast becoming a serious contender in the commercial vehicle space. According to a new report from tech analysts IDTechEx, it may not be long before they’re also the cheaper option.

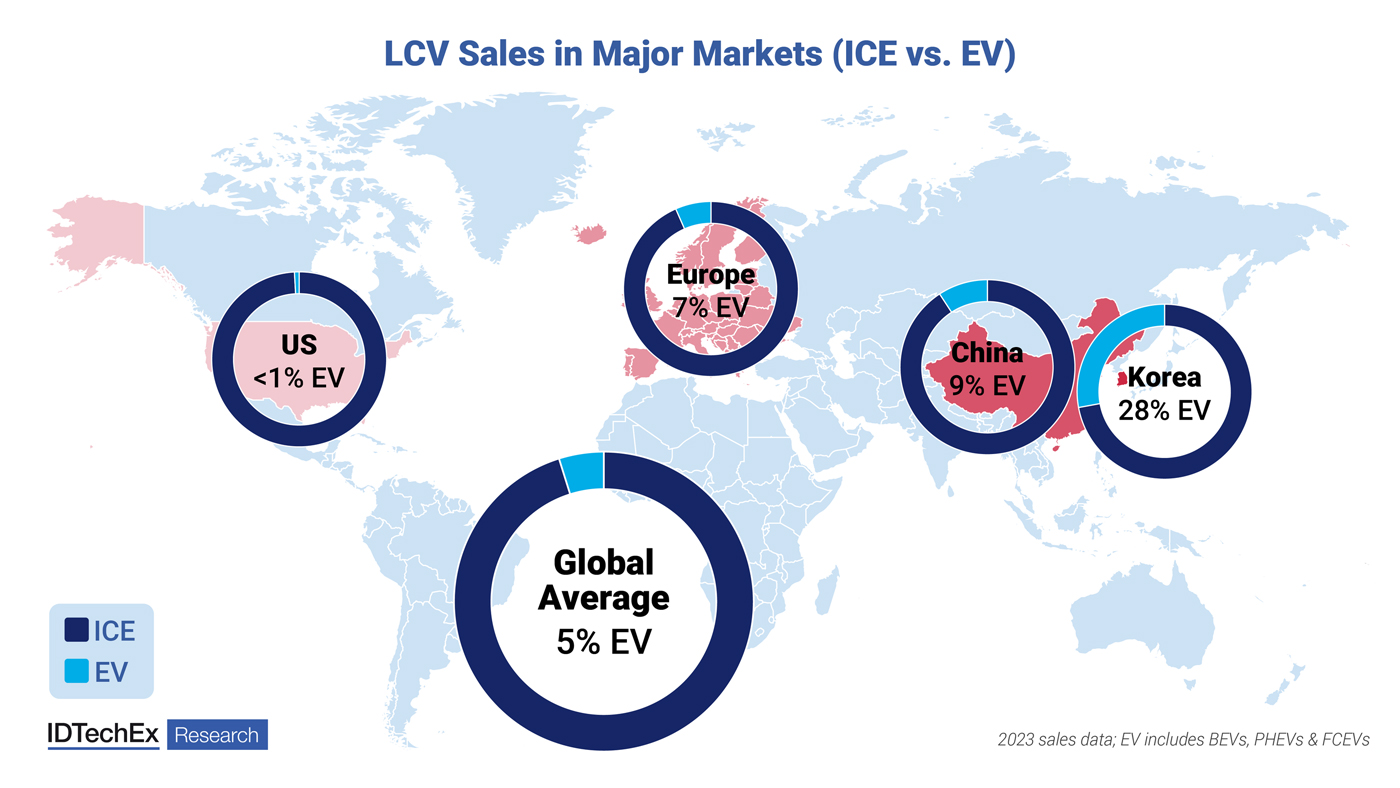

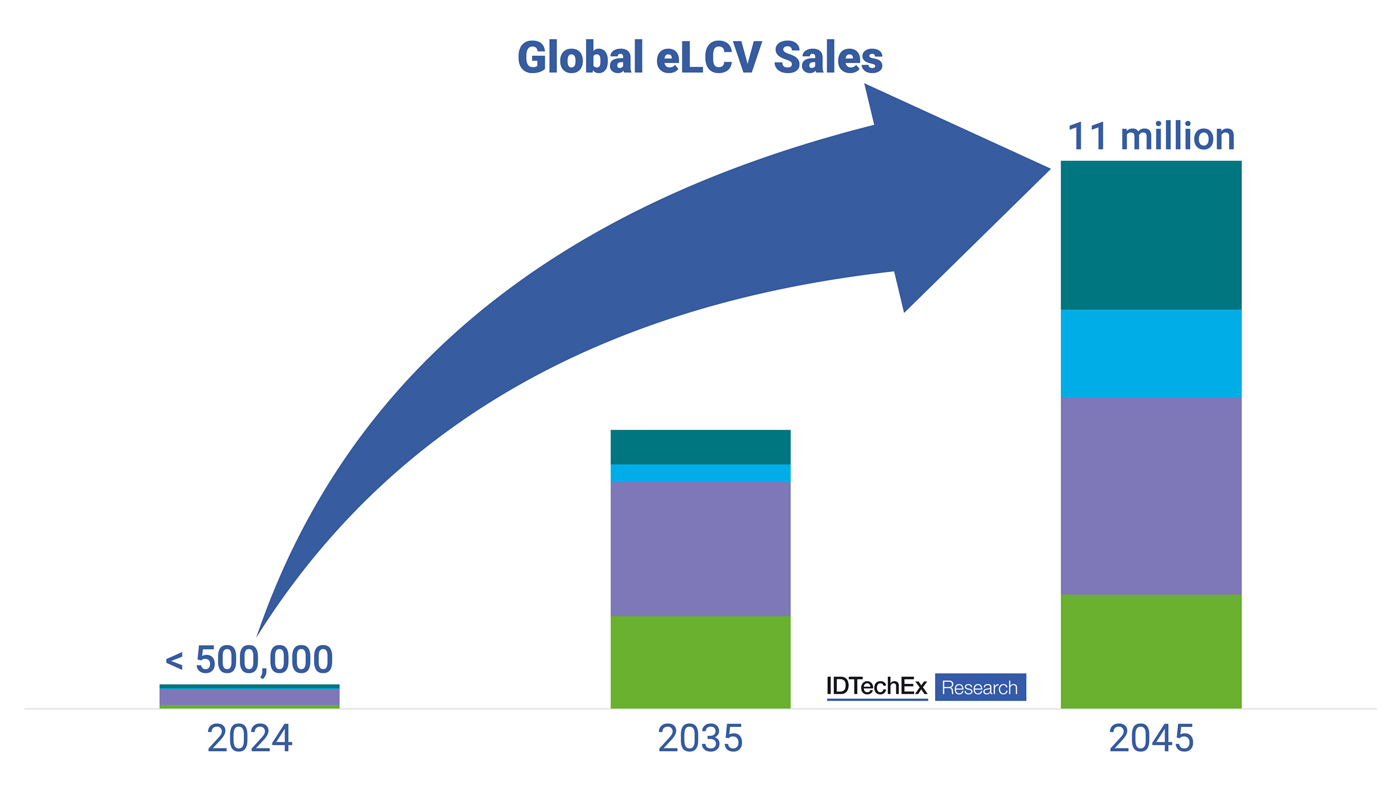

In 2023, about 5% of all global light commercial vehicle (LCV) sales were electric vehicles (EVs). In 2024, fewer than 500,000 electric LCVs (eLCVs) were sold globally.

That’s all about to change. eLCVs are no longer a science experiment. They’re maturing quickly – and when it comes to cost, they’re catching up fast. As a result, IDTechEx predicts that annual eLCV sales will exceed 11 million units by 2045.

That’s the future, but for now, buyers remain wary for one important reason: electric vans cost more to buy than their diesel counterparts. The biggest culprit, of course, is the battery – along with the drivetrain. Unlike diesel engines, which have been mass-produced for decades, EV components are still gaining economies of scale.

“Where eLCVs do struggle is in their higher upfront costs. The CAPEX of an eLCV is still higher than that of combustion, with the cost of battery systems and drivetrains being a major contributor to the price premium,” notes Pranav Jaswani, technology analyst at IDTechEx. “eLCVs also have higher R&D costs and are currently lacking in the economies of scale which may bring prices down. The price premium of an eLCV varies by manufacturer, region, and size – sometimes as low as 10 to 20% for a smaller vehicle or reaching up to 40 to 60% for the largest ones.”

It’s not just the purchase price that’s problematic, though: electric vans lose their value faster, eating into any savings made through lower running costs.

Cheaper to run – by a long shot

Despite the higher purchase price, however, the day-to-day costs of owning and operating an electric van are significantly lower. “A standard eLCV can save as much as US$1,300 (about R25,000) per year on energy alone compared to a diesel alternative,” Jaswani notes. That’s because electricity is far cheaper than diesel in most markets, while there is also protection from those wild price swings at the pumps.

Electric vans also have fewer moving parts, which means less maintenance, fewer breakdowns, and more time on the road. IDTechEx estimates that this could mean two extra days of operation per vehicle per year – not insignificant for time-sensitive businesses.

Getting closer to TCO parity

The holy grail for electric van adoption is total cost of ownership (TCO) parity – the point where, over a five-year period, an electric van costs the same or less than its diesel counterpart when you add everything up: purchase price, fuel, maintenance, insurance, and resale value.

We’re not quite there yet, but things are moving quickly in the right direction. On one side, the cost of building electric vans is coming down; on the other, the cost of running diesel vans is going up.

Batteries are getting better – and cheaper

One big driver of this shift is the rapid development in battery technology. As batteries become more efficient and cheaper to produce, the overall cost of eLCVs will continue to fall.

IDTechEx highlights new developments by companies like Stellantis, GM, and CATL, who are investing heavily in battery packs designed specifically for eLCV use.

At the same time, improvements in motor efficiency and lightweight materials mean future vans could need smaller batteries to do the same job, cutting costs further.

Diesel vans face growing regulatory pressure

On the diesel side, things aren’t looking quite as rosy. Stricter emissions laws in developed countries are making diesel engines more expensive to build and operate. From complex exhaust systems to post-sale compliance costs, fleet owners will soon find it harder – and pricier – to stick with combustion engines.

While South Africa appears to be lagging in the environmental Dark Ages (no loadshedding-related pun intended), many cities across Europe have already introduced low-emission zones or zero-emission zones, including London, where non-compliant vehicles must pay £12.50 (roughly R311) per day to enter certain areas. France and the UK – two of Europe’s largest LCV markets – are leading the way in this regard.

Furthermore, governments are throwing in financial incentives to speed things along. Grants for buying electric vans can range from $3,000 to $10,000 (about R57,000 to R195,000) depending on the country, helping to close the initial price gap and support long-term savings.

The perception problem: resale value and trust

Even as costs drop, one major barrier remains: trust. Buyers still worry about battery degradation, the cost of a replacement battery, and the unknowns of resale value. Until more used eLCVs hit the market and build a track record of reliability, depreciation will remain a key hurdle.

Customer perception is slow to shift, but as more electric vans hit the road and prove themselves, resale values will improve – and insurance premiums will drop too.

A tipping point is coming

According to IDTechEx’s report, parity between diesel and electric vans – in both upfront cost and TCO – is within reach. As costs continue to fall for eLCVs and rise for diesel, the maths will start to favour electric options more clearly – and that’s before we even talk about brand image, CSR goals, or the growing pressure on companies to decarbonise their fleets…

Clearly, in the next five to 10 years, we’re going to see a major shift. Electric vans won’t just be the cleaner option – they’ll be the obvious one.

* Find more information on the full report, Electric Light Commercial Vehicles 2025–2045: Markets, Players, Forecasts, here.

Published by

Charleen Clarke

focusmagsa