Air cargo impacted by black swan event

Air cargo impacted by black swan event

Conflict in the red sea disrupting ocean freight services has been an immensely impactful “black swan” event for air cargo. Charleen Clarke reports that there have been +11% increases in global air freight demand for the fourth straight month, partially as a result of the unrest.

The global air cargo market is on the boil! According to Global Market Insights, the global air cargo market was estimated at US$200 billion in 2022 and is anticipated to hit US$300 billion by 2032, thanks to the rising need to transport high-value and time-sensitive products such as electronics, perishable goods, auto parts, and pharmaceuticals.

Growth is already being seen, and the International Air Transport Association (IATA) has just released data for March 2024 global air cargo markets that show continuing strong annual growth in demand. Total demand, measured in cargo tonne-kilometres (CTKs), rose by 10.3% compared to March 2023 levels. This is the fourth consecutive month of double-digit year-on-year (YoY) growth. The 10.3% YoY growth in industry CTKs was driven by traffic on international routes, which expanded by 11.4% YoY in March, helped by the rapidly increasing demand for e-commerce services. Importantly, all regions experienced both month-on-month (MoM) and YoY expansions, the former in double digits and the latter in excess of 3%.

International CTKs of airlines registered in the Middle East and Africa posted the highest annual growth rates, with 19.9% and 14.1% respectively. These airlines were closely followed by those registered in Asia Pacific (13.8%), Europe (10.0%), and Latin America (7.8%). North American carriers experienced the lowest YoY growth with 3.1%. IATA maintains that carriers are likely benefiting from continued conflict and drought-induced disruptions in the Suez and Panama Canals, which have been affecting global maritime shipping capacity.

Capacity, measured in available cargo tonne-kilometres (ACTKs), increased by 7.3% compared to March 2023 (10.5% for international operations).

“Air cargo demand grew by 10.3% over the previous March. This contributed to a strong first quarter performance which slightly exceeded even the exceptionally strong 2021 first quarter performance during the Covid crisis. With global cross-border trade and industrial production continuing to show a moderate upward trend, 2024 is shaping up to be a solid year for air cargo,” says Willie Walsh, IATA director general.

April sees growth

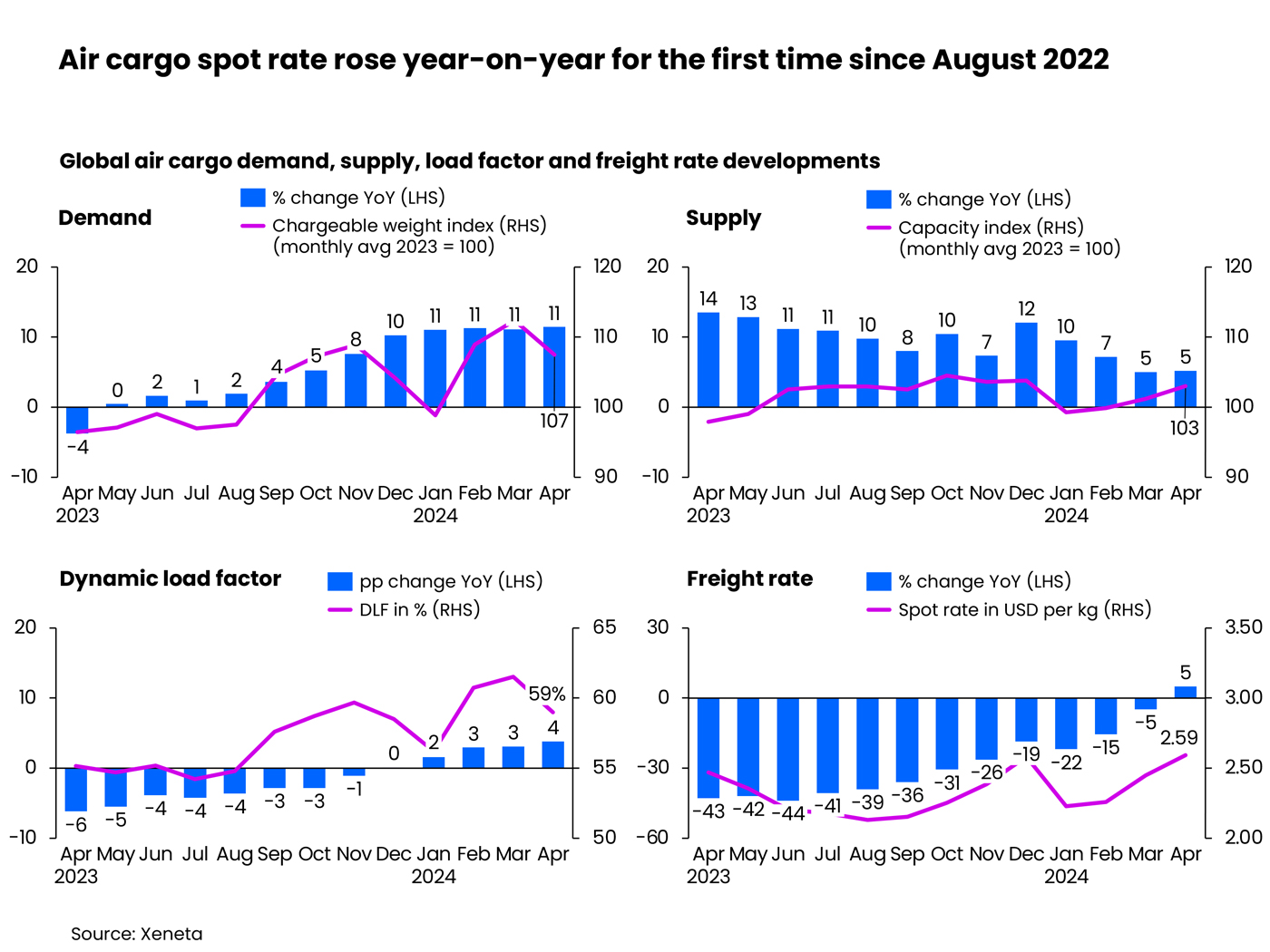

Meanwhile, Xeneta has just released its latest data analysis, which reveals that April registered the fourth straight month of +11% increases in global air freight demand. The injection of extra cargo capacity as airlines launched their (European) summer schedules boosted supply growth by +5% YoY in April. This placed expected downward pressure on the so-called “dynamic load factor”, dropping from 62% in March to 59% in April. The dynamic load factor is Xeneta’s measurement of cargo capacity utilisation based on the volume and weight of cargo flown alongside the available capacity.

In April, YoY growth of the global air cargo spot rate turned positive for the first time since August 2022, increasing by 5% due to a combination of Middle East conflicts and strong e-commerce demand. As a result, the average global spot rate rose to US$2.59/kg, its highest level this year.

“In absolute terms, the levels of demand and supply growth are what we expect to see in April, after what was a typically strong month of March at the end of Q1. April may well represent an interlude to a quieter period for the air freight market,” says Niall van de Wouw, Xeneta’s chief airfreight officer. He adds that the growth in the spot rate was very much driven by regional developments, as well as a case of market sentiment tending to follow market fundamentals. “This is what happens in jumpy market conditions. The freight rate in April was a reaction to high first quarter volumes,” he explains.

Future outlook

According to DHL’s Airfreight State of the Industry report (April 2024), quarter two of 2024 could also be eventful for the air freight industry. It says service disruptions will continue, with the Middle East conflict escalation, along with Panama Canal disruptions continuing to affect airfreight market and rates. “The Taiwan semiconductor manufacturing disruption may affect future air cargo volumes while expected airport strikes in Europe could lead to additional flight disruptions in the coming weeks,” the report warns.

Economic indicators point towards modest growth within the US and EU, while emerging markets are expected to pick up pace. “Consumer price inflation rates expected to decline further in 2024–25 amid supply-demand rebalancing, but services inflation rates pose challenges,” the report reveals.

Demand will however remain high. “Sea-air service demand is anticipated to remain high due to recent Red Sea conflict escalations. The continuous boom in e-commerce and regional modal-shift demand may prevent the historical summer airfreight slump. E-commerce air cargo is forecasted to reach 13% of global air freight in 2024, driven by rapid expansion,” it predicts.

Turning to capacity, the DHL report anticipates the growth of widebody belly capacity out of Asia. This is expected to accommodate the boom of e-commerce demand. The ageing freighter fleet is set for replacement by new aircraft, alongside increased belly capacity orders.

Finally, what will happen to rates? Van de Wouw says shippers and forwarders are coming to terms with delays in ocean freight services due to diversions in the Red Sea. “We have clearly seen a push for airfreight capacity around the Indian subcontinent because of the Red Sea disruption, but this impact is easing as businesses which depend on ocean freight are now planning in longer lead times. So, we expect the recent surge in demand for airfreight in this region to lessen,” he expands.

The experts at DHL don’t necessarily agree. Its report predicts overall downward pressure on rates in the upcoming months, except for specific trade lanes, where the ongoing surge in e-commerce and lingering uncertainty in the Red Sea are expected to bolster rate levels.

Clearly, the black swan is not without its advantages…

- IATA’s full report can be read here.

Published by

Charleen Clarke

focusmagsa