Road freight breakthroughs needed to realise AfCFTA’s potential

Road freight breakthroughs needed to realise AfCFTA’s potential

The African Continental Free Trade Area (AfCFTA) holds immense promise for unlocking interstate trade across Africa. However, according to NICK PORÉE, infrastructural and logistical challenges – including costly border delays and inefficient port operations – continue to hamper progress.

The AfCFTA agreement, signed by 54 of the 55 African Union member countries, encompasses a market of 1.3 billion people with a combined GDP of US$3.4 trillion. The agreement aims to stimulate economic growth, increase intra-African trade, and drive investment across the continent. However, implementation has been sluggish. The Economic Commission for Africa reports that many African countries continue to trade more with global markets than with their regional counterparts. Key barriers such as inadequate infrastructure, limited financing, and weak governance structures persist; if these challenges can be resolved, interstate trade within Africa could increase fivefold.

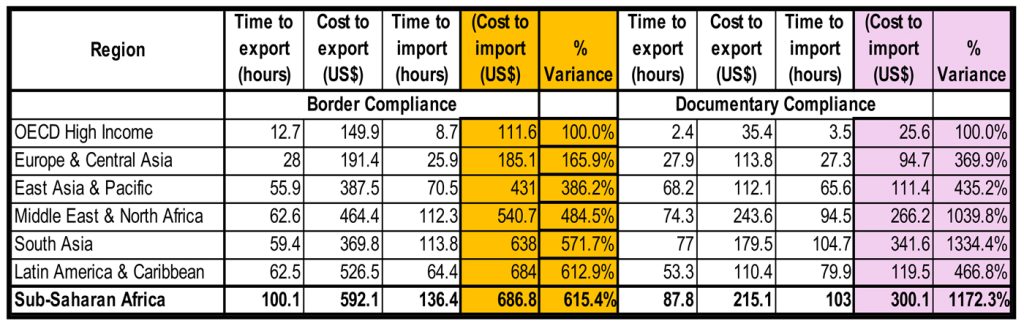

Sub-Saharan Africa’s logistical inefficiencies are starkly apparent when compared globally. The World Bank’s 2018 Cost of Doing Business report showed that the costs of border compliance for imports were 600% higher than in high-income Organisation for Economic Co-operation and Development (OECD) countries, while documentary compliance costs are 10 times greater. While recent data suggests marginal improvement, excessive costs driven by inefficiencies at ports, corridors, and borders continue to hinder competitiveness.

Ports rated poorly

South African ports have been rated poorly compared to other regions, underscoring an urgent need for reform. The reliance on state-owned monopoly structures has led to a recurring burden of inefficiency; the Transnet National Ports Authority (TNPA) lacks the resources to overhaul maritime logistics from legacy systems to a modern, competitive model. By contrast, other countries are taking steps to privatise port operations to boost efficiency and reduce fiscal pressures. Brazil, for example, plans to sell 23 port terminals to the private sector. Within Africa, ports at Maputo, Beira, Walvis Bay, and Dar es Salaam are expanding rapidly, diverting trade away from South Africa.

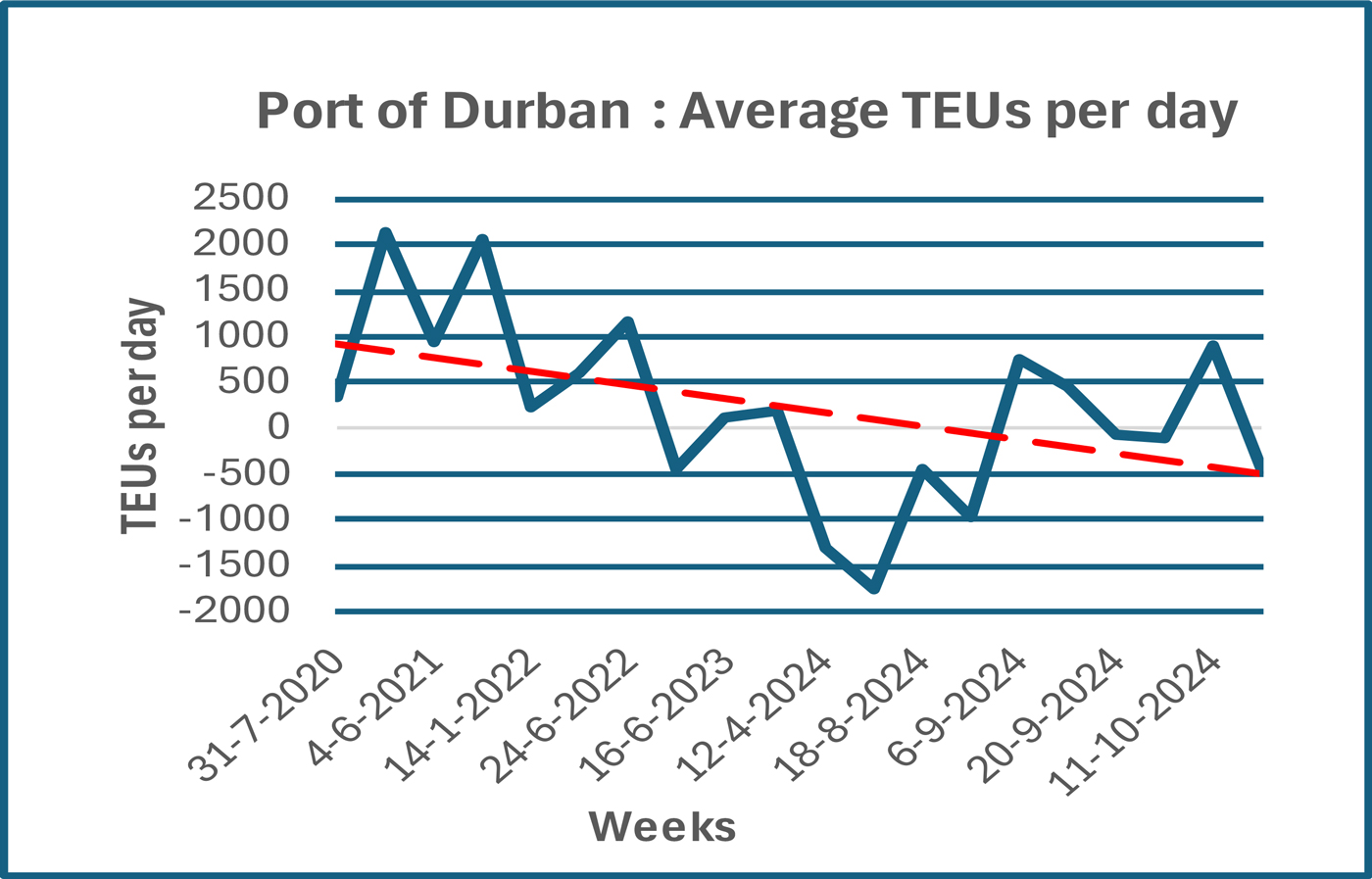

South Africa’s approach to port recovery relies heavily on extensive investments in current systems, yet there is little evidence that these investments will achieve the international standards needed for the country’s reindustrialisation targets. Analysis of container handling performance in Durban reveals further decline since 2020, suggesting urgent reforms are needed.

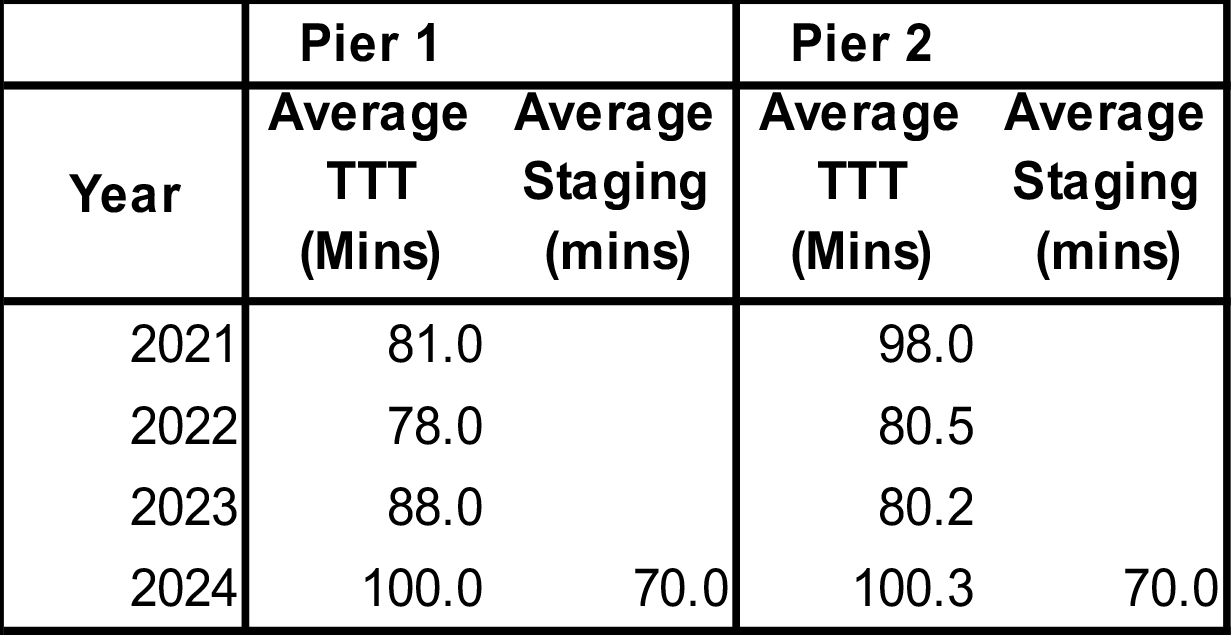

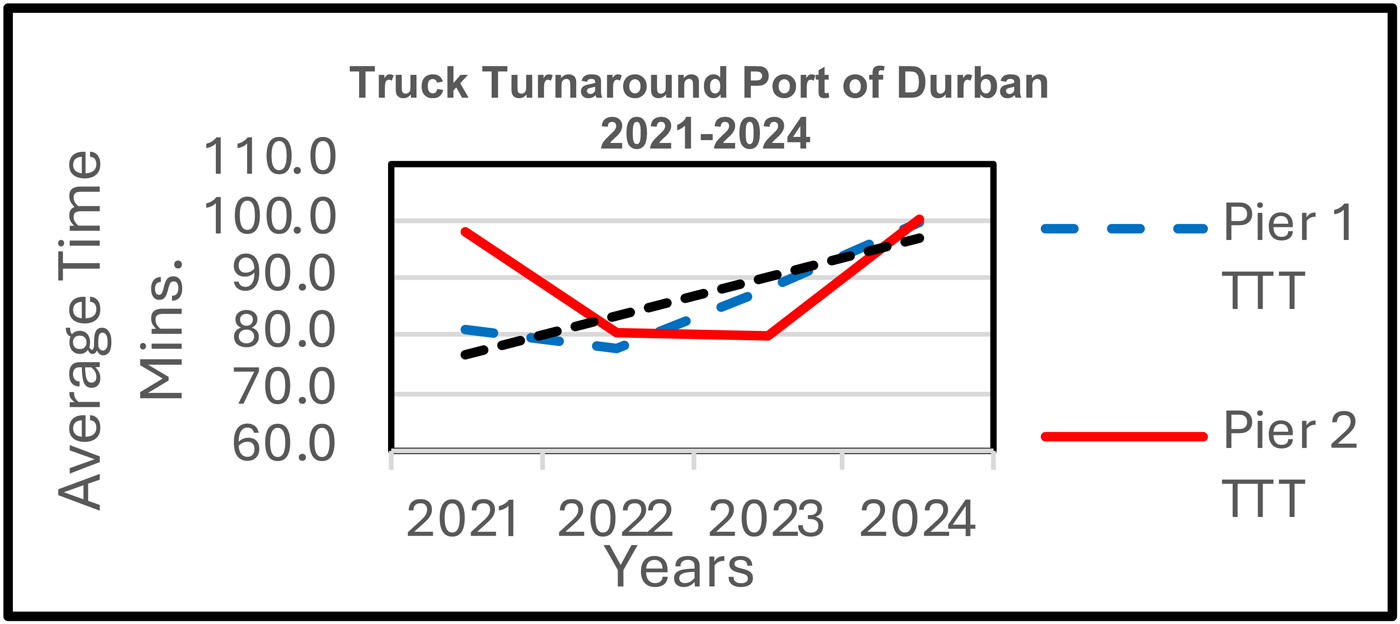

Landside performance in Durban poses additional challenges to the road freight sector. As reported by the Road Freight Association (RFA), turnaround times are worsening. Between 2021 and 2024, truck turnaround times increased by 20% to an average of 100 minutes per terminal, with an added average staging time of 70 minutes at the A Check facility before port entry. Given an average cost of US$20, or R350, per hour, the resulting standing time incurs an additional US$36 (over R600) per container, amounting to roughly R1.5 billion annually.

Costly regional delays

Weekly reports on corridor and border performance from a collaborative initiative between the Federation of East and Southern African Road Transport Associations and logistics data analytics company, Crickmay (FESARTA-Crickmay) – conducted for Business Unity SA (BUSA) and the SA Association of Freight Forwarders (SAAFF) – reveal the substantial costs of regional delays. For the week ending 13 October 2024, cross-border queue times averaged 6.8 hours, costing the transport industry approximately US$7 million (R123 million). Average cross-border transit times were around 6.5 hours, at an indirect cost of US$5.5 million (R97 million). The total indirect cost for the week reached an estimated US$12.5 million (R220 million). For industrial users, additional costs arise from inventory holding, production delays, and trade losses, which may far exceed these transport costs.

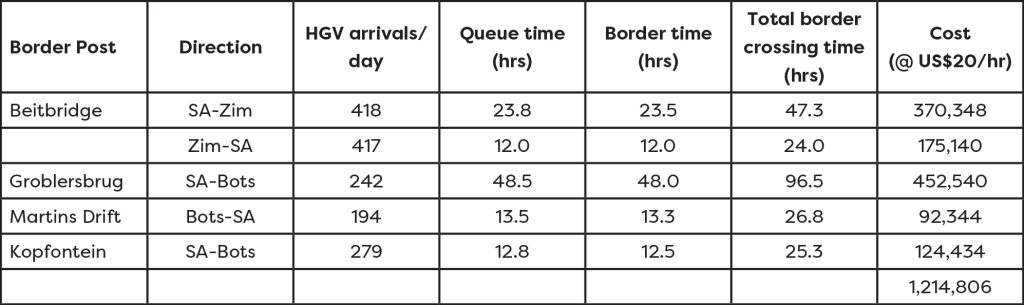

Delays at South African borders

South Africa’s busiest borders, which see the highest truck volumes, are also the most prone to significant delays. Average delay times mask the disparity between high-traffic and low-traffic borders, where smaller crossings generally manage well with lower volumes. For example, incoming trucks to South Africa face shorter delays, as a higher proportion are empty vehicles, underscoring inefficiencies in processing on the South African side.

Weekly transport costs of US$1.2 million (R21 million) amount to over R1 billion annually, driven by a failure to modernise border facilities to align with traffic demands. Despite this substantial drain on the economy, authorities have shown limited concern. The National Infrastructure Plan and Ministry of Public Works’ strategic plans favour projects such as toll roads in the Transkei or harbours in the Northwest, while logistics infrastructure remains neglected.

A promising appointment

The road freight industry in Southern Africa must rally for improved organisation and stronger advocacy – and a recent appointment by the African Union of Transport and Logistics Organizations (UAOTL) in Morocco may mark a turning point. Mike Fitzmaurice, CEO of FESARTA, has been elected as the vice president for Southern Africa within the UAOTL. He will be reporting to the president in Morocco and has a sectorial committee comprising Zambia and Zimbabwe reporting to him. There are five vice presidents reporting to the president, one for each of five regions: North, West, Central, East, and Southern Africa.

The UAOTL is poised to drive meaningful improvements. Fitzmaurice’s daily engagement with transporters through FESARTA’s Transit Bureau provides valuable insight into the challenges and solutions needed to boost regional efficiency. There’s no better man for this job, and we congratulate him on his appointment!

Published by

Nick Porée

focusmagsa