Fasten your seatbelts for unpredictable turbulence

Fasten your seatbelts for unpredictable turbulence

The 2024 Air Freight Outlook report from market analytics platform Xeneta predicted a return of “classic seasonality”. However, another turbulent year has followed, mainly due to the dramatic rise of e-commerce out of Asia and the impact of conflict in the Red Sea. According to the latest report, these market forces are set to spill over into 2025.

The 2025 Air Freight Outlook report, authored by Niall van de Wouw, Xeneta chief airfreight officer, and Wenwen Zhang, Xeneta airfreight analyst, presents five key themes for 2025.

Uptick in traditional air cargo market

Xeneta reports that global gross domestic product (GDP) growth should remain stable at 3.2% in 2025 according to the International Monetary Fund (IMF), while global inflation is expected to fall to 4.3%. “Sustained GDP growth will support growth in air freight demand in 2025, but disinflation (the slowdown of inflation) will also be key,” it notes. However, disinflation could be disrupted by rising commodity prices resulting from geopolitical trade tensions and labour shortages due to US immigration control.

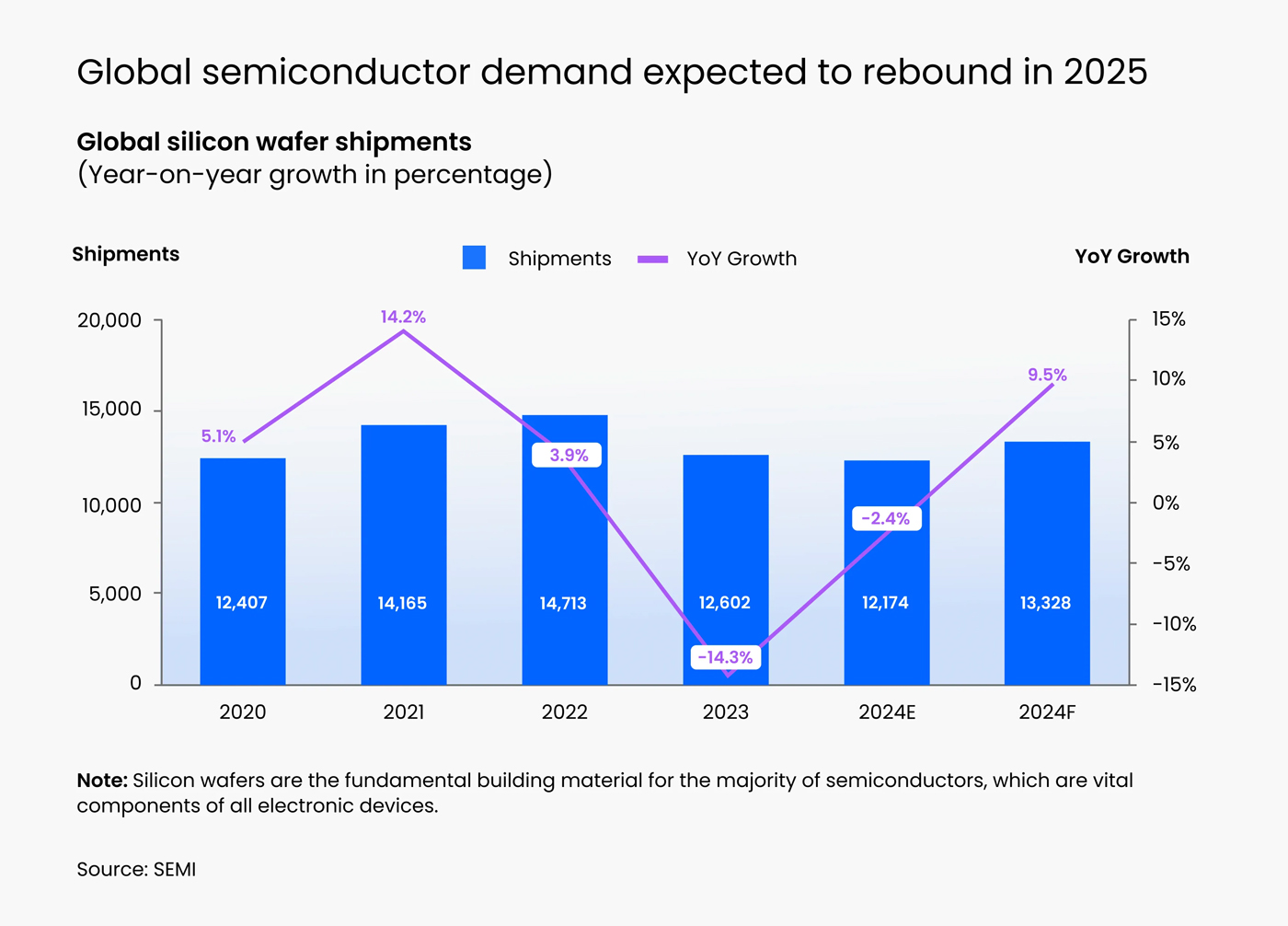

“(The) ‘traditional’ air cargo market – predominantly B2B goods that have been shipped by air for many years on established corridors – remained muted in 2024, but that is likely to change in the year ahead,” write the authors, adding: “A rebound of the traditional air freight market will be supported by demand for semiconductors related to generative AI and advanced computer processing.”

“The AI wave will lift the recently-stagnant B2B airfreight market. But this will not have as dramatic an impact on global demand when compared to factors in 2024 such as Red Sea Crisis and the rise of e-commerce,” says co-author Zhang. “Shippers on corridors with lower demand growth are still at risk if airlines remove capacity from secondary trades to meet the increasing demand out of Asia.”

Continued disruption in ocean container shipping

Conflict in the Red Sea has seen a mode shift from ocean to air during 2024 and the report says that this will remain a key theme in air cargo demand in 2025, although with the shift already largely established, this is unlikely to contribute much to air cargo demand growth.

“If there is a major change in the geo-political situation and a large-scale reopening of the Red Sea, there could be a renewed acceleration of mode shift and air cargo demand growth for a few months,” emphasises the report.

“The Red Sea effect on the air freight market has plateaued and might even recede in 2025. This could provide a bit of breathing space for shippers, but the threat of further disruption remains given the geo-political climate,” explains Van de Wouw.

The report further notes that US East Coast port strikes in October contributed to a 12% month-on-month jump in Europe-to-US air cargo volumes; the threat of further strikes at these and Gulf Coast ports in January could cause congestion and deteriorating schedule reliability, contributing to an increased shift to air cargo.

Robust e-commerce growth and increasing regulation

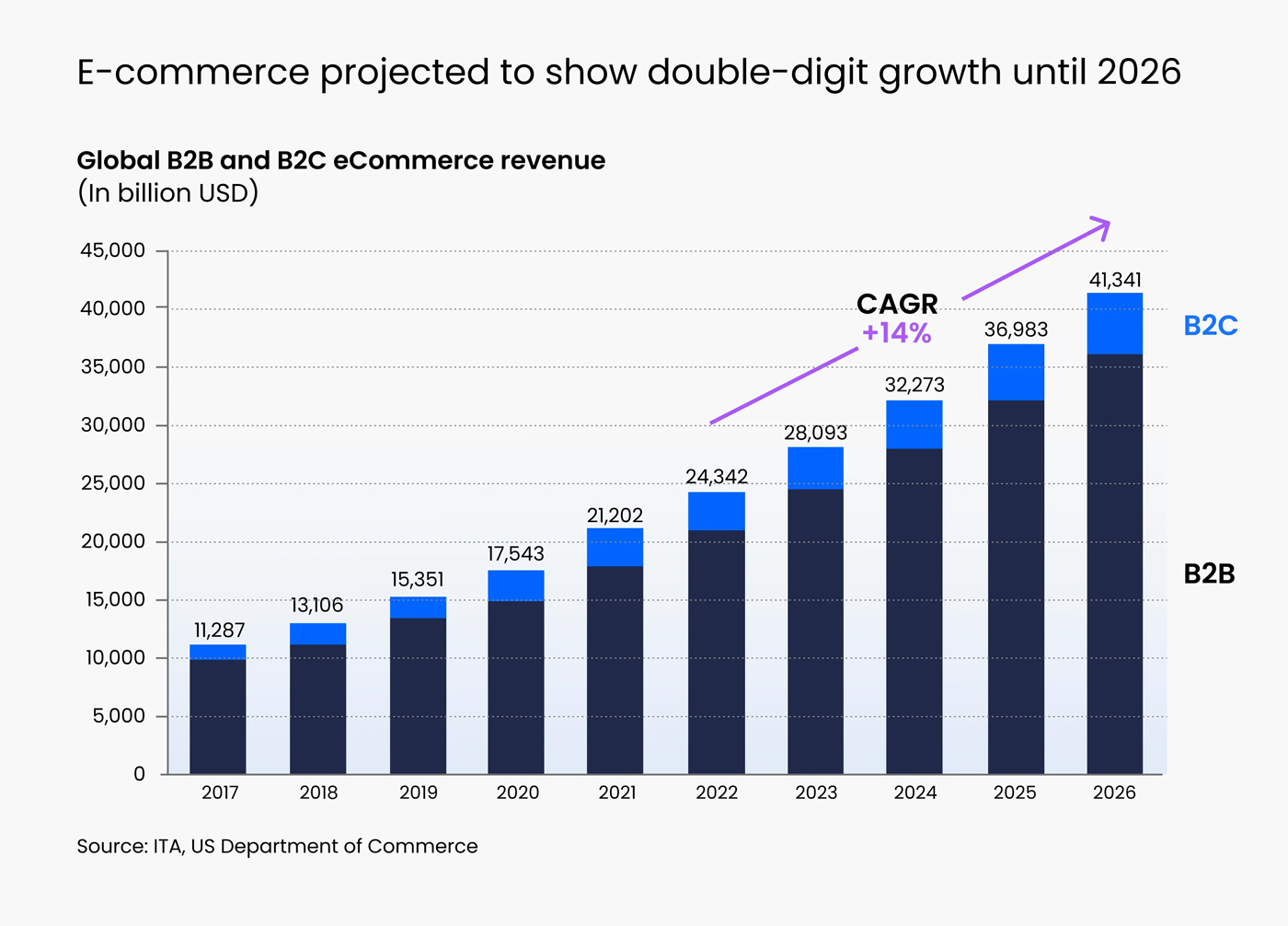

The dramatic rise of cross border e-commerce in 2024 indicates that this will remain a key driver for demand growth. The report notes that global B2C and B2B e-commerce is estimated to grow 14% per annum until 2026, with South Asia and Southeast Asia to experience the fastest growth.

Increasing regulatory scrutiny could, however, impact e-commerce growth, with the report highlighting the EU investigation of Chinese e-commerce platform Temu for a potential breach of the Digital Service Act, and Indonesia’s ban of Temu over fears of its impact on local enterprises.

“The US is increasing scrutiny by tightening customs and border checks… (and) proposing new de minimis legislation, which is seen as a loophole allowing large volumes of e-commerce goods from China to enter the US without incurring import duties,” it continues.

The report also cites potential geopolitical factors relating to the incoming US administration’s stated intention to raise tariffs on imports, stressing: “If political intervention dampens growth in e-commerce volumes from China to the US, airlines would need to recalibrate the capacity and demand balance on this fronthaul corridor.”

“E-commerce is a local (phenomenon), but impacting shippers around the globe. You better stay up to date on how airlines are developing their network as changes could tighten capacity in markets that have no direct link with the e-commerce volumes,” advises Zhang.

Global air cargo supply and demand

Xeneta reports that the traditional air cargo market’s resurgence, disruptions in ocean supply chains, and the rise of e-commerce will all contribute to an expected global air cargo demand growth of 4 to 6% in 2025.

“While the demand growth is expected to slow in 2025, importantly it will still outpace air cargo capacity supply, which is set to grow by 3 to 4%,” it notes. “If demand growth does outpace supply growth in 2025, it is likely air freight rates will remain elevated – but it is important to remember that experiences will vary dramatically depending on the region and trade lane.”

Slower capacity growth in 2025 also stems from supply chain issues and aircraft manufacturing delays. “It is unlikely that the tight air freight market of 2024 will ease in 2025. It would be wise to manage the expectations of your internal stakeholders,” expands Zhang.

Wild cards and emerging trends

“We only need to look at the sudden escalation in the Red Sea in December 2023 to understand the impact geopolitical tensions can have on air freight. 2025 is likely to see more of the same,” Xeneta emphasises. The proposed US import tariffs, increased criminal activities in the air cargo supply chain linked to rising geopolitical tensions, severe weather and climate change, and increasingly stringent environmental regulations will have important consequences for the sector.

“For example, the EU’s ReFuelEU initiative will require aviation fuel suppliers to blend a minimum of 2% sustainable aviation fuel (SAF) in EU airports starting in 2025, increasing to 70% from 2050. As SAF is three to five times more expensive than fossil fuel, this regulation is expected to increase air freight costs by 1-3%,” states the report.

“Please return to your seat and fasten your seatbelt – we are entering an area with unpredictable turbulence. The best approach to a period of high uncertainty is to be alert to quantitative signals from the marketplace as it could avoid shippers over-reacting and creating a vicious circle of escalating rate,” says Van de Wouw.

Growing market maturity

The report rounds off by noting that the growing maturity in the market in 2024 has helped to maintain a level of stability during what could have been a rocky festive period.

“If 2024 has taught us anything, it is to expect the unexpected and be ready to act decisively to meet emerging challenges… Air cargo is operating at full steam, but shippers and air freight vendors have established more proactive, data-driven relationships,” it notes. “If 2025 brings further disruption, then it must be seen as a huge positive that these stronger relationships are in place… the industry has the best chance of overcoming these challenges by working together”.

Published by

Rowan Watt-Pringle

focusmagsa