After the Bell: Throwing money at Transnet is not the answer

After the Bell: Throwing money at Transnet is not the answer

Now that Eskom has managed to keep the lights on for almost a year, a political consensus seems to be developing that the methodology used to save Eskom can simply be transferred to Transnet. Sadly, TIM COHEN doesn’t think this is the case.

After the ANC’s pre-Budget National Lekgotla on the final weekend of January, Bloomberg reported transformation committee chairperson Zuko Godlimpi as saying that Transnet needed “something massive”.

While Godlimpi didn’t mention a number the ANC considers sufficient to fund Transnet, he did say that “had it not been for the R245-billion support package [for Eskom] we would not be here, and this was against institutional advice [because] everyone had given up on the capacity of Eskom”, adding, “The debt programme was structured in a very detailed and specific manner, in that it was not to deal with its overall company problems, but towards a specific intervention.”

As it happens, Treasury already provided a R47-billion guarantee for Transnet way back in 2023. In a sense, this was forced by the fact that Transnet had at that stage started breaching its debt covenants.

As it stands, Transnet is sailing very close to the wind. In its results to September, Transnet acknowledged that it was still in breach of debt valued at around R45 billion, which technically allows lenders the right to declare a default. In this case, however, Transnet reported having sought waivers from its lenders to prevent the triggering of default events; fortunately, all submitted waivers have been accepted, which provides the company with temporary relief. Presumably, Treasury’s guarantee in 2023 helped.

It’s important to know which covenant was breached. In Transnet’s case, it was Cash Interest Coverage (CIC) ratio, which measures the company’s ability to cover interest expenses with earnings before interest, taxes, depreciation, and amortisation (Ebitda).

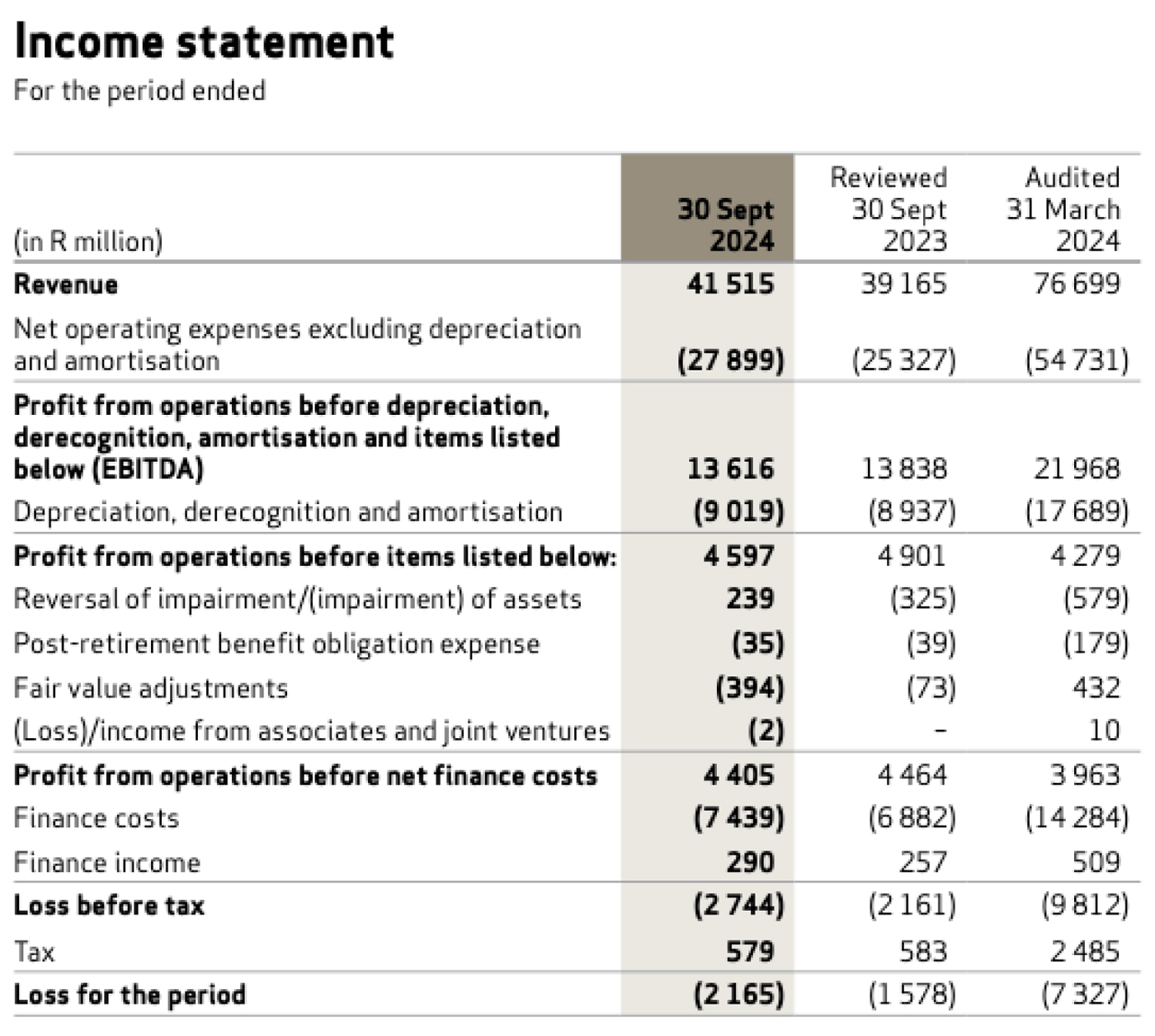

Many of Transnet’s debt agreements require a CIC ratio of at least two times, with some stipulating a minimum of 2.5x. However, in the six months to 30 September 2024, Transnet’s CIC ratio fell to 1.9x below the required thresholds.

This is a lesser breach than, for example, a debt-to-Ebitda ratio breach, which for highly leveraged companies would be somewhere between 4x and 6x. That could trigger immediate repayment demands. The calculation is simply the debt divided by Ebitda, and since Transnet has an Ebitda of about R21 billion and debt of R138 billion, it must be getting pretty close to these levels (if it hasn’t breached them already). Likewise, by my reckoning it must be close to breaching some of the other serious covenants, like the Tangible Net Worth covenant and the Fixed Charge Coverage Ratio covenant, which is the company’s ability to cover fixed costs (e.g. rent, leases, debt service) with earnings.

The problem is that Transnet’s operation metrics are heading in the wrong direction. The September interim period recorded increased revenue (great!) but also higher operating expenses (not so great). The numbers are eye-popping: the loss for the period is up about 30% to just over R2 billion, and all divisions saw a decline in income.

There is possibly some good news on the horizon, with Richards Bay Coal Terminal reporting in late January that exports went up 10% to 52 million tonnes in 2024, from 47.2 million tonnes a year earlier – the first time in five years it has recorded an increase.

But Transnet’s finance costs are about R15.1 billion a year, which is almost equal to capital investment of R16.7 billion. That is less than half of what Transnet spent 10 years ago – and you can see it in the dilapidated stations, huge quantities of discarded infrastructure, and no apparent attempt to deal with the problems quickly and decisively.

Every time I hear Transnet executives talk about their business, I’m struck by the enormous lack of urgency; and every time I hear ANC politicians talk about the problem, I’m struck by the enormous lack of reality.

As just one example, Godlimpi was reported as saying: “If you give Transnet R47 billion, you are not helping them to solve the large-scale capital requirements that they have. At a structural level, it’s still far less than what they require. [We] should give them a comprehensive one-off. Hence, we should do an Eskom on Transnet.”

The problem is that, to my mind, this is a grand misdiagnosis. The solution to Eskom’s problem was not (or at least not only) giving the organisation a(nother) huge bailout. The solution was allowing the private sector to provide its own electricity. The result was that Eskom could maintain its current, reduced level of electricity provision without overly straining the system.

The same solution is not quickly and easily available to Transnet. You can’t build new ports, for example, as quickly as you can install a photovoltaic electricity array. I know that some quite big mines in South Africa, for example, built solar systems in a few months, reducing their Eskom-generated electricity requirements by half. You just can’t do that with a railway line or a fuel pipeline.

Transnet can go some way along this path by outsourcing its port management. It has tried to do so, but its first effort has ended up snarled in the court system after Transnet chose the more expensive bidder. Transnet could obviously also do better at upgrading its infrastructure. But the ANC’s instinctive reaction to any crisis is rather to throw taxpayers’ money after it. In this case

Published by

Tim Cohen

focusmagsa