The ways of the railways

The ways of the railways

South Africa’s railway story is a tale of government control, missed opportunities, and monopolistic challenges. NICK PORÉE discusses how policy decisions shaped the transport sector and the rise of road freight – and how private sector inclusion might revitalise this critical infrastructure.

The editorial of the This is SAR handbook in 1977 provided clarifications of the railway managerial perspectives on the provision of port and transport services to the country. The perspectives have been supported by government for over 100 years and are the primary reason that the railways are commercially uncompetitive and ineffective in meeting market demand.

I quote: “The mandate conferred on the SA railways in 1909 was to administer the railways, ports and harbours on business principles. Due regard was to be paid to provision of cheap transport for agricultural and industrial development, and for the settlement inland in all provinces of the agricultural and industrial population.” This was accepted as a national obligation to provide all transport.

According to the railway interpretation, “The Road Transportation Act of 1930, was primarily intended to regulate the chaotic conditions [read market competition] that were emerging as the result of the emergence of the road vehicle as a viable and efficient transport mode.” There were 16,000 commercial vehicles on the roads in 1930…

It must be noted at this point that the railway mandate was rigidly interpreted to outweigh market demand for competitive service (a single port and transport operator). The SA Railways and Harbours (SAR&H) – as a state-owned enterprise (SOE) – proceeded to plan and coordinate the supply of goods and passenger services throughout the country, including the connections to the international maritime industries via the ports. The connection to the ports was provided by extensive railway yards (with very complex and archaic delivery of cargo to the wharfs), while local cartage services by road were also a port monopoly. There was continual cross-subsidisation within the overall organisation, with port revenues compensating for railway expenses in services to remote areas.

Numerous commissions of inquiry modified internal procedures but never made any suggestion of railway competition or increased competition from road freight. It was not until 1977 (after considerable opposition) that local port to city cartage was opened to private sector hauliers. It was not until 1985 that the National Transport Policy Study led to the deregulation of long-haul road freight transport. This, after railway transport had reduced by 50% due to increasing strategic movements by road (as noted in This is SAR) and ignored market demand by railways.

The immediate growth of the road haulage industry confirmed the suppressed market demand for efficient distribution services. However, it did not prompt a redesign of port facilities to support road freight or relax the railway monopoly.

An attempt at retaining some breakbulk led to the railway investing in a very complex mini-container railway service (PX) between major centres with high-tech Auto-Sort facilities in Johannesburg, Durban, and Cape Town. According to the Research Unit for Transport and Physical Distribution Studies (RTPS) at the (then) Rand Afrikaans University (RAU), the system was based more on the railway perspectives of logistics than the market demands of private industries, and failed after about two years.

The next executive decision by the railway board (then SA Transport Services, or SATS), with recommendations by overseas consultants, was to abandon all breakbulk services and concentrate on more profitable trainload contract bulk haulage. No effort was made to open breakbulk or intermodal railway opportunities to private sector train operators, so facilities and equipment were simply abandoned – and rapidly vandalised. A large proportion of non-core lines were allowed to fall into disrepair and breakbulk transport became a tightly contested competitive road haulage market, whilst the railway continued to focus on coal, iron ore, manganese, and other bulk mineral exports, as well as timber, fuel, and bulk industrial trainload commodities.

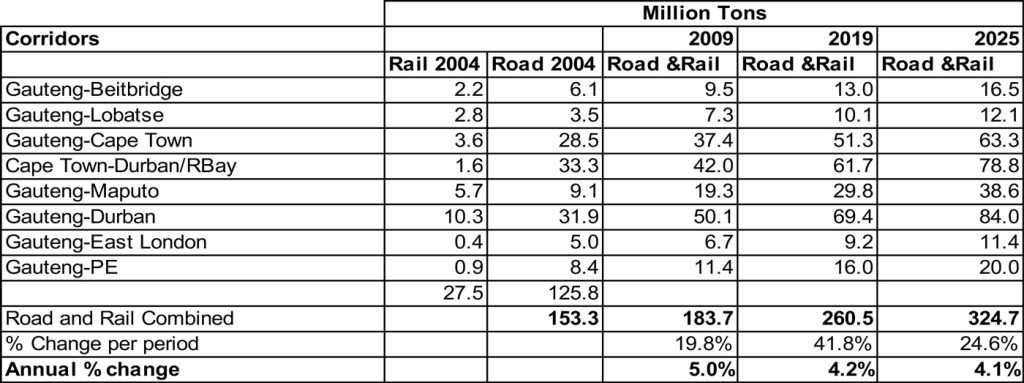

By 2004, it was evident that the railways (then Transnet) were not investing sufficiently in equipment replacement and maintenance of the extensive track network. The Bureau for Economic Research (BER) at Stellenbosch University was commissioned to do a market demand study to motivate a massive reinvestment programme. The study produced optimistic data (see the accompanying table), which was used to justify contracts for the supply of over 1,000 locomotives. The contracts were greatly inflated by corruption and have left the SOE with unsatisfactory locomotives and R135 billion in debt.

Due to the fact that the government’s policy position is focused on state ownership, in all of the abovementioned strategic planning, the obvious alternative option – widening the provision of rail transport services by opening access to the under-utilised rail network and encouraging investment by private operators – was not considered.

South Africa’s rail struggles mirror a broader global challenge of achieving sustainable economic growth, as noted by the International Monetary Fund (IMF). “If there is one economic challenge that cuts across most of the globe, it is growth. Or rather the shortage of it,” wrote IMF managing director Kristalina Georgieva in a recent article in The Washington Post.

The solutions are to ease regulatory barriers to entrepreneurship, incentivise and channel long-term savings to productivity-enhancing innovation, adapt tax systems and bankruptcy codes to support a dynamic business environment, and more. As Georgieva noted: “Better productivity growth will mean better prospects for people and ultimately a more stable, peaceful world. This is why the IMF was created – and why we resolutely confront the jobs-and-growth challenge the world faces today.”

Moving on to specifically local developments, the announcement by the president that there would be a move to open access for private Train Operating Companies (TOCs) on the national network caused a flurry of speculation followed by release of a “Roadmap” and a “Private Sector Participation (PSP)” plan by the Department of Transport, along with the creation of a Transnet Rail Infrastructure Manager (TRIM) division by Transnet. The TRIM terms of access were gazetted but, as they imply ownership, slot allocations, and train coordination of the network by a competing TOC, they have been received with scepticism by many in the industry.

More recently, the CEO of TRIM stated that the pit-to-port line connecting Mpumalanga’s coal basin near Ermelo to the Port of Richards Bay would not be open to third parties in the near future. Furthermore, the latest reports suggest that this pit-to-port line experienced the largest number of security incidents in 2024 (around 1,334). This gives further indications that the TRIM proposals will continue to support the Transnet monopoly and exclude private TOC investment.

The current level of de-industrialisation and reducing investor confidence in South Africa requires urgent policy action to encourage private sector entrepreneurship and reduced government involvement in managing industrial activities. The recent cooperation on the Lebombo Corridor shows what can be done when all sectors participate dynamically in coordinating competitive commercial transport in all modes.

Published by

Nick Porée

focusmagsa